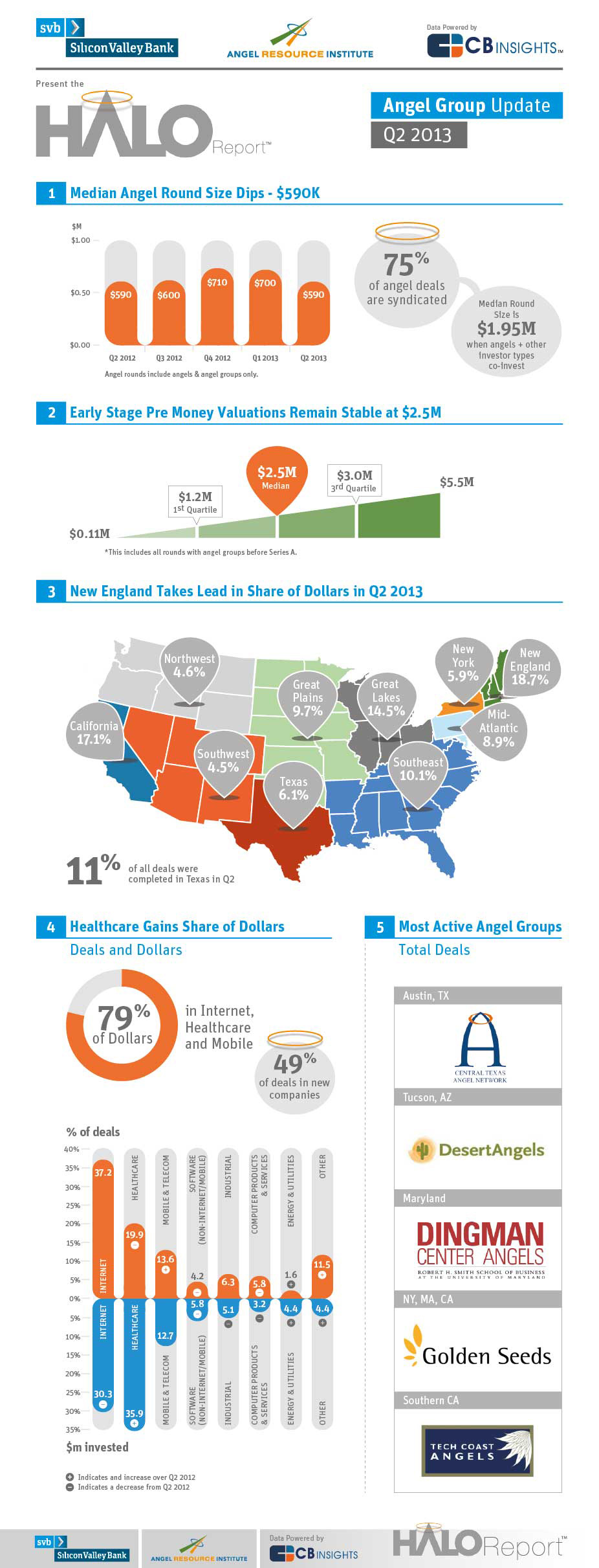

The Angel Resource Institute (ARI), Silicon Valley Bank (SVB) and CB Insights have released the Q2 2013 Halo Report, a national survey of angel group investment activity, which finds median angel round sizes down to $590K per deal, median pre-money valuations remaining stable at $2.5M and 74% of deals are syndicated. When angels co-invest with other types of investors the median deal size is $1.95M.

US angel investment continues to be dispersed nationwide and the most active angel groups in the quarter are:

• Central Texas Angel Network

• Golden Seeds

• Desert Angels

• Dingman Center Angels

• Tech Coast Angels

• Alliance of Angels

• Houston Angel Network

• Launchpad Venture Group

• New York Angels

• Sand Hill Angels

For the first time, the report separates Texas, which has 11% of angel group deals in Q2, behind California, New England and the Southeast. New England-based angel groups closed deals worth slightly more than deals in California in Q2. The sectors getting funding remain concentrated in Internet, healthcare and mobile, with 71% of completed Q2 deals and 79% of Q2 dollars in these categories.

“Clearly, angel groups are successfully syndicating opportunities, ” said Rob Wiltbank, Vice Chairman of Research, Angel Resource Institute. “Syndication remains highly concentrated geographically, as with formal venture capital, but with growing online angel activity, it will be interesting to see how this changes in the future.”

Halo Report Q2 2013 Highlights:

Round Sizes

Median angel round sizes were flat year-over-year, but dipped to $590K in Q2, from $700K in Q1 and after three quarters of growth. When angel groups co-invest with other types of investors, the median round size is trending up to $1.95M in Q2 from $1.4M in Q1. Seventy-four percent of angel group deals are syndicated.

Valuations

Pre-money valuations in early stage companies remain steady at $2.5M, but they are creeping downward, with both the high and low end of the distribution declining.

Locations

Seventy-two percent of deals were completed in the angel groups’ home state in Q2, dipping slightly from Q1, but remaining fairly consistent over the course of the prior year.

Geography

Seventy percent of angel group deals in Q2 were completed outside California and New England, although 36% of dollars are invested in these regions, which is a nearly ten point gain over the prior quarter and year. California led in number of deals, with 17% share of angel group investments, but was edged out slightly by New England in the total dollars invested during the quarter.

Sectors

Together, Internet, healthcare and mobile companies completed 71% of angel group deals and received 79% of angel group dollars, an increase from Q1 and the prior year.