Propelia is a UK accelerator that has worked with early stage founders since 2012, developing the concept of ‘Pilot Rounds’ in the pre-seed space. A Pilot Round that essentially identifies and connects founders with aligned investors, to enable them to quickly leverage SEIS capital to fuel, test and iterate strategic market assumptions over the next 6 months.

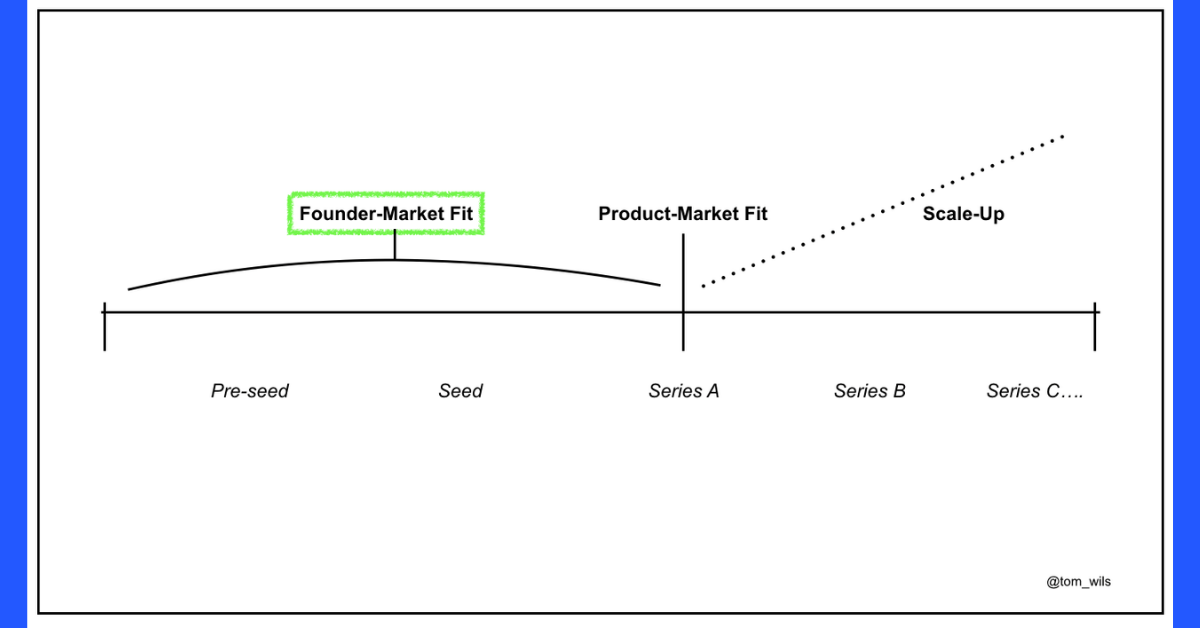

It’s a shift towards ‘Founder Market Fit’ which is seeing new tools, frameworks and approaches currently being developed, to enable greater deal flow alignment and fluidity in the early stage space – where ideally everyone wins.

Dan Simmons, Propelia CEO, shares his view of taking a different perspective for early stage fundraising:

Why understanding a founder’s journey through the 3 lenses of Projection > Planning and Proof can help you better evaluate the uncertain market problem now available to navigate and disrupt.

There are very few data points to help successfully plot the course forward if you are a founder or investor trying to launch into an uncertain market sector – particularly in these post-Covid times. This is why start up evaluation often revolves around incorporating and using future facing concepts and lenses like OKRs and NPS.

In truth for both parties this often feels like a ‘finger in the air’ exercise at best. A planning and strategic framework which can just about be used long enough in order to create and gain enough comfort to cross the line, move forward and often then quickly adjust as events invariably change on the ground.

Perhaps instead of looking forwards we need to to more frequently start looking backwards. Back into a better understanding and appreciation of the founder’s journey. Not just how they got from A > B > to their current pitch deck, but towards the consistent patterns of behaviour, exploration and also mistakes that have informed how they have arrived at a point where they wish to try and tackle an uncertain market problem and navigate with the associated risks.

Propelia has taken this approach with its founders since 2012. By doing so we have consistently found that when you truly look at a founder who has a nuanced and ongoing journey into their market sector, you commonly can discern similar signs, patterns and behaviours. These often enable both founder and investor to better assess whether the timing is now right to venture further and essentially invest in each other.

Here’s some tools and tips that over the years we’ve found useful to hopefully better help you with a different kind of looking backwards evaluation:

TIP 1: PROJECTION

Too often when we talk about founders we refer to how they are disrupting the present. Almost every pitch deck in the last 5-10 years has featured commentary, speculation and projection on how their start up will disrupt their sector – often within the next 2-3 years.

However a new key element post-Covid has recently been added to and baked into the mix. That of the uncertain future. Seemingly the only thing that’s now certain is that this new feature of uncertainty will bear relevance and have to be factored in going forward.

Image © Propelia Ltd 2020

This can lead to a form of paralysis between founder and investors as they try and understand, incorporate and navigate this new terrain into their evaluation.

It’s here where introducing a new horizon around the concept of the ‘Almost Now’ can prove to be very useful in breaking this deadlock. The Almost Now becomes like a whitespace of a horizon that can be projected onto and forecasted into that is suspended between the Disrupted Present and the Uncertainty Future. It is essentially saying this is the horizon around which we can now collectively meaningfully explore and evaluate, with the understanding that it will be inflected and affected constantly by changes in market conditions.

Interestingly it is founders whose journey opens up a unique path into this horizon of the Almost Now who find themselves most comfortable working and operating in this liminal space. For investors this is an immediate piece of feedback that if a founder can behave in this way addressing the Almost Now, then they are likely to be more adept and agile to work with when going forward.

TIP 2: PLANNING

Building on the above, any founder that has a journey that justifies them launching into a disrupted market sector should start to demonstrate and embody an understanding around a new framework that places the navigation of uncertainty as the key new function that informs future planning and strategy.

Like with PROJECTION above, founders with a deeper journey and understanding will be more comfortable baking in these two new functions into their plans and pitches. Equally founders without this journey will find this very uncomfortable and may demonstrate signs that they wish to only look forward via more traditional planning and strategy lenses and insights.

This new framework is emerging and impacting across all businesses and represents a real competitive opportunity for those start ups that are ready and agile enough to organise and execute in this way.

TIP 3: PROOF

Finally, there are a couple very simple questions that as a founder you should be ready for and as an investor you can ask instead of things that would represent a traditional elevator pitch. Questions that quickly provide and demonstrate some PROOF that the founder’s journey might currently have relevancy, currency and influence over their market sector.

These questions are:

Question 1

Who could you now send a text to that is recognised as having authority over the market sector you’re looking to launch into that would i) immediately consider your question and ii) likely respond to you with their insight and input within the next 24 hours?

Question 2

Which email conversation in your inbox represents an ongoing dialogue with someone of influence that if it comes to fruition, could add immediate acceleration to your planning and strategy?

The 3 x tips above are just some initial ways to try and reveal insight into a founder that might be far easier to glean and assess by looking backwards, as opposed to consistently when approaching a new founder treating them as if they are essentially a blank slate and asking about future projections that both parties know are guesstimates at best.

Just by being aware that there is this often underexplored terrain in the founder’s journey, that can start to be evaluated by simple lenses like the ones above. might mean that in these uncertain times, we can start better identifying, supporting and backing founders that are genuinely ready to cross the threshold in the unknown of the next stage of their venture.

Dan Simmons // Founder – Propelia – September 2020