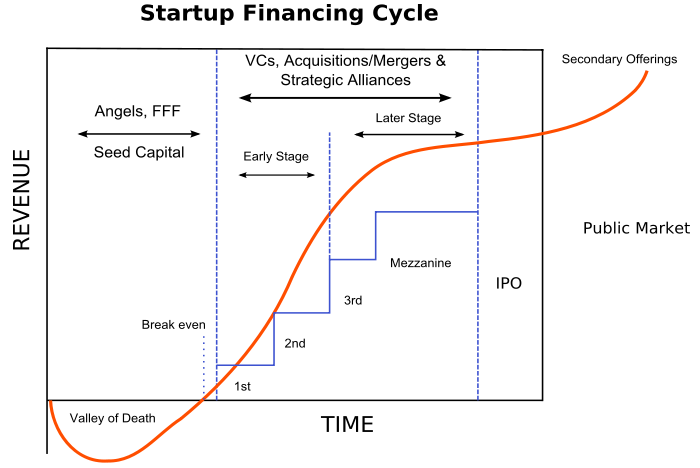

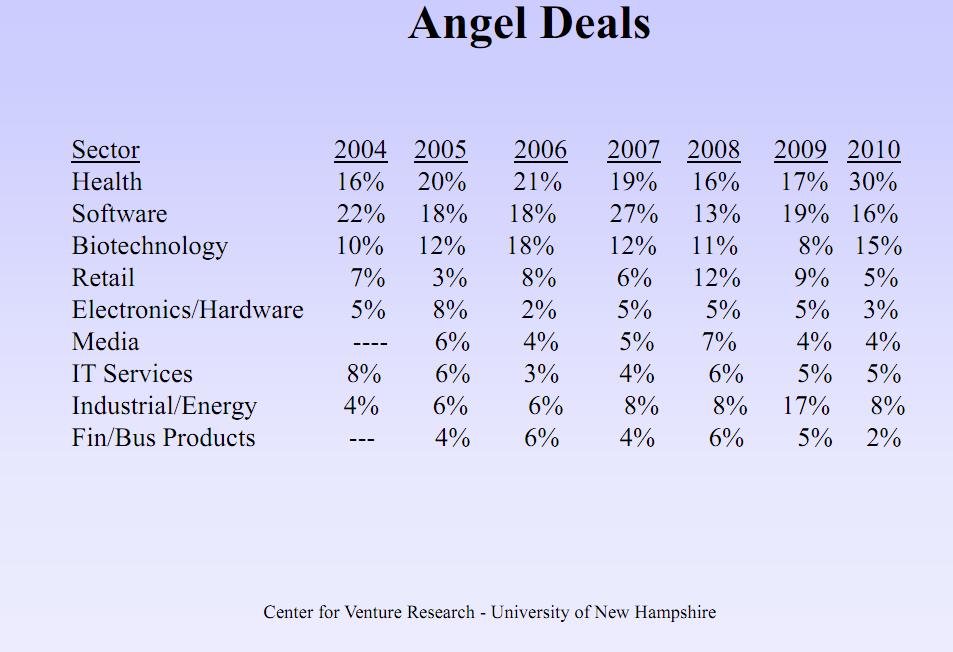

Business loans, angel investors and venture capitalists — in many cases, these three entities are determining the success or failure of small businesses across the country.

This graphic takes a deep look at each source of capital, have uncovered how much money is going where, and identified common considerations, compromises and benefits of each. In the end, this gives a good visual look at the state of business financing in today’s economy.

Source: https://www.lendio.com/blog/visual-funding-infographic/