In his second guest post for Angel Investment Network, Dan Simmons, CEO of Propelia, explains ‘How understanding the shift from Product Market Fit to Founder Market Fit in the pre-seed space can now help influence your early stage thinking and planning’:

Understanding The Shift

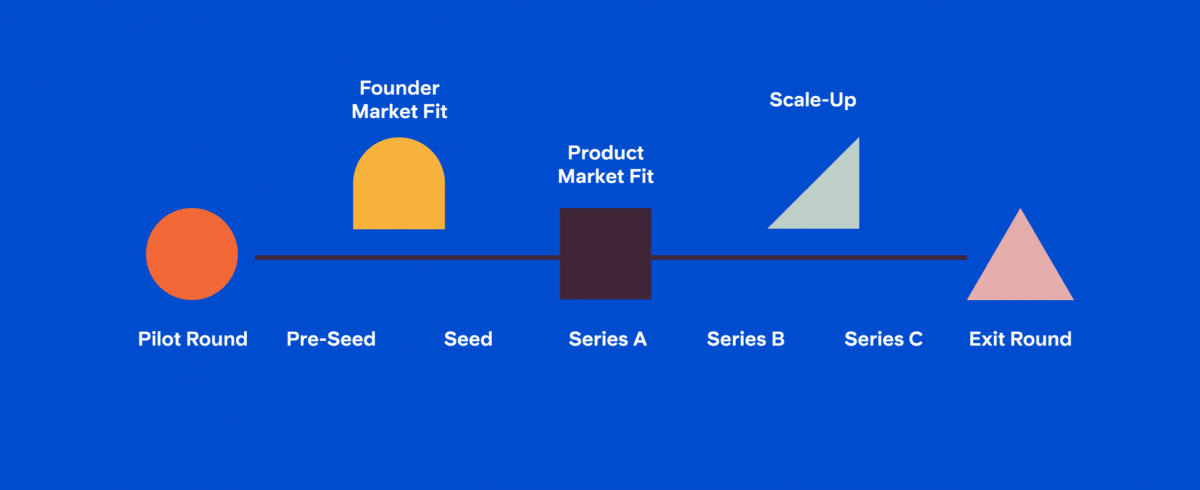

There is a recognisable shift starting to happen in the early stage space. A shift that is important to be aware of and understand whether you are a founder or investor. A shift away from Product Market Fit and towards Founder Market Fit around and for pre-seed investment. This shift essentially means the way certain angel investors are starting to evaluate early stage founders is beginning to change. Change away from the traditional lenses that model and evaluate Product Market Fit towards a new phase where different tools, frameworks and assessment criteria are at play.

We can see this shift clearly by comparing and contrasting the two diagrams below:

We can see from the Product Market Fit diagram, that as you move forward, it essentially at each stage relies on and is informed by tools and lenses like OKRs, YOY, NPS, KPIs, CAC and CLV to chart founder progression and development. A progression that many founders when trying to structure and project the progress of their start up onto find very difficult to navigate. A difficulty that often then causes them to come up with and put forward assumptions and future projections that are essentially best guesses – just to align with Product Market Fit based questioning and be attractive to and try and close their potential investment.

However we can see that by shifting the focus towards Founder Market Fit, the nature of the early stage journey distinctly and meaningfully changes.

Here we can see that different criteria are being used to assess value and progress of the founder, that utilise much more human language and exploratory values when compared to the tools and lenses of Product Market Fit. This is critical as to why this shift is increasingly attractive to and in the interest of early stage pre-seed founders.

Why This Shift Is Occurring Now?

For a long time the tools of Product Market Fit have been the only way to really evaluate an early stage founder and their future start up journey. This often creates an asymmetry and many ensuing systemic problems in the ongoing dynamics between founder and investor. Both parties when evaluating an early stage funding deal, are of course looking to gain comfort that the road ahead is valuable and worth pursuing together. The tools around Product Market Fit have been an attempt to create that comfort and generate that degree of future certainty.

A certainty that was always speculative at best. Ask any founder who has been asked over and over again to create and then endlessly tweak a 3 year spreadsheet of projections and you will be met with the frustrations and self-evident limitations of this methodology and approach in the pre-seed space.

However will market conditions now very much being set to ‘Uncertain’ post-COVID, it is clear that any founder predicting more than 6 months out is simply putting ‘their finger in the air’ and practising some sort of start up fortune telling with no real basis in the reality of events unfolding on the ground. For the first time, both investors and founders can agree that a change is needed to adapt to this underlying uncertainty – particularly around evaluating those first 6 months in the early stage space. This is all important in creating the conditions for the shift from Product Market Fit to Founder Market Fit.

Who Are Some Of The Key Stakeholders Helping Make This Shift Happen?

This shift is being fuelled by various key stakeholders in the early stage space that are sensing the market timing and opportunity to fuel and propel it forward. These range from early stage funds that are realising that updating towards Founder Market Fit is both valuable, viable and attractive as their pre-seed market positioning. Indeed by adopting this approach it could immediately make them more ‘founder friendly’ and differentiate them from their rival funding firms who are still focused on the tools of Product Market Fit and therefore lack this new perspective. Forward Partners and The Fund are good examples of this or early stage firms talking this language.

However there are also additional stakeholders that are worth noting and exploring further. Here’s a few of them worth exploring.

The legal parties that specialise in the early stage space. Companies like SeedLegals offering Agile Funding solutions that enable founders to take on smaller tranches of funding in a much more fluid and ongoing manner than if they were completing a larger round – see here:

The increasing awareness around Founder wellbeing and how applying the lens and pressure of Product Market Fit too early can have adverse effects on mental health. Many founders report the same symptoms and sleepless nights having to prove the projections they previously plucked from the ‘spreadsheet ether’ last quarter at their next investor meeting. See founder peer support groups like Foundrs who are there to ‘help one another break new ground without breaking ourselves’ and Courier’s excellent Founder wellbeing report.

In recent years this shift has been enabled by the application of R&D and Innovation Grants to the early stage space by forward thinking companies such as GrantTree and Data Fox. These companies have been able to reclaim capital spent and invested in innovative new products, services, processes, software or systems and are often willing to be engaged on a no-win, no-fee, no-risk basis. This has provided an alternative route to financing and capital in the early stage and is particularly well orientated to outputs of Founder Market Fit.

A final stakeholder that has emerged in recent years that helps value this shift differently are firms like Coller IP and Valuation Consulting who are managing to put the softer and intangible assets – like brand, business models, know-how and sweat equity – on the early stage balance so that they can be factored into larger rounds. This starts to assign an actual value to the dynamics of Founder Market Fit that were previously considered to have a marginal worth at best when compared to the more tangible metrics and measures of Product Market Fit.

How This Shift Might Affect Early Stage Funding?

If you are currently engaged in an early stage funding round or indeed considering one, it might be useful to pause and think about the difference in approaches between Product Market Fit and Founder Market Fit. Whilst this shift is visible and happening it is still quite new, even to sophisticated investors who regularly fund founders and their pre-seed start ups.

You should both as founders and investors feel like you have the permission from the outset to discuss and delineate which approach is being taken. They are both very different with different paths with different evaluative criteria and measured outcomes. Critically once you are down one path and everyone is aligned to that approach, it is notoriously hard to reverse out of.

However factored in up front an awareness of the choice around this shift could help fuel a different type of initial conversation between founder and investor that helps from the outset frame and articulate future aims, expectations and values. It could even form part of an early whiteboarding or brainstorming session between founder (and their team) and potential investors.

Just by being aware of the shift and bringing it into the conversation is at the very least a sophisticated early basis for discussion.

How Do You Assess Where You Are On This Shift?

Finally a quick diagram to assess where you are at in relation to this shift. It is suggested that if you are in the pre-seed space then Founder Market Fit may well be the more suitable approach. This may also be the case if you are still in the Seed funding stage.

However it is likely that if you are in the Series A or above that you are further down the line in the territory and terrain of Product Market Fit and its evaluative tools and approach are still more suited to you.

The good news for everyone, is that by being aware of where you are in relationship to this shift, then all conversations and their related lenses, tools and frameworks, can start to hopefully become more ‘fit for purpose’ and ultimately as a result, more valuable for all parties and stakeholders involved.

Dan Simmons – Propelia Founder // dan@propelia.com

Propelia is the UK accelerator navigating the use of Pilot Rounds in the pre-seed space in our post-COVID times. A Pilot Round is designed to rapidly connect early stage founders with aligned investors, to enable them to leverage SEIS capital to fuel, test and iterate uncertain market assumptions and prove Founder Market Fit over the next 6 months. Once completed, this enables them to then evaluate and ideally increase the value of the greenlighting of a subsequent larger round to fund the further launch of their product and operations. All diagrams in this article remain the Copyright of Propelia Limited