In November 2011, Wildfire conducted an ROI survey of over 700 marketers from all around the World. The results were compiled into an easy-to-digest infographic, found below.

News About Startups, Entrepreneurs & Angel Investors

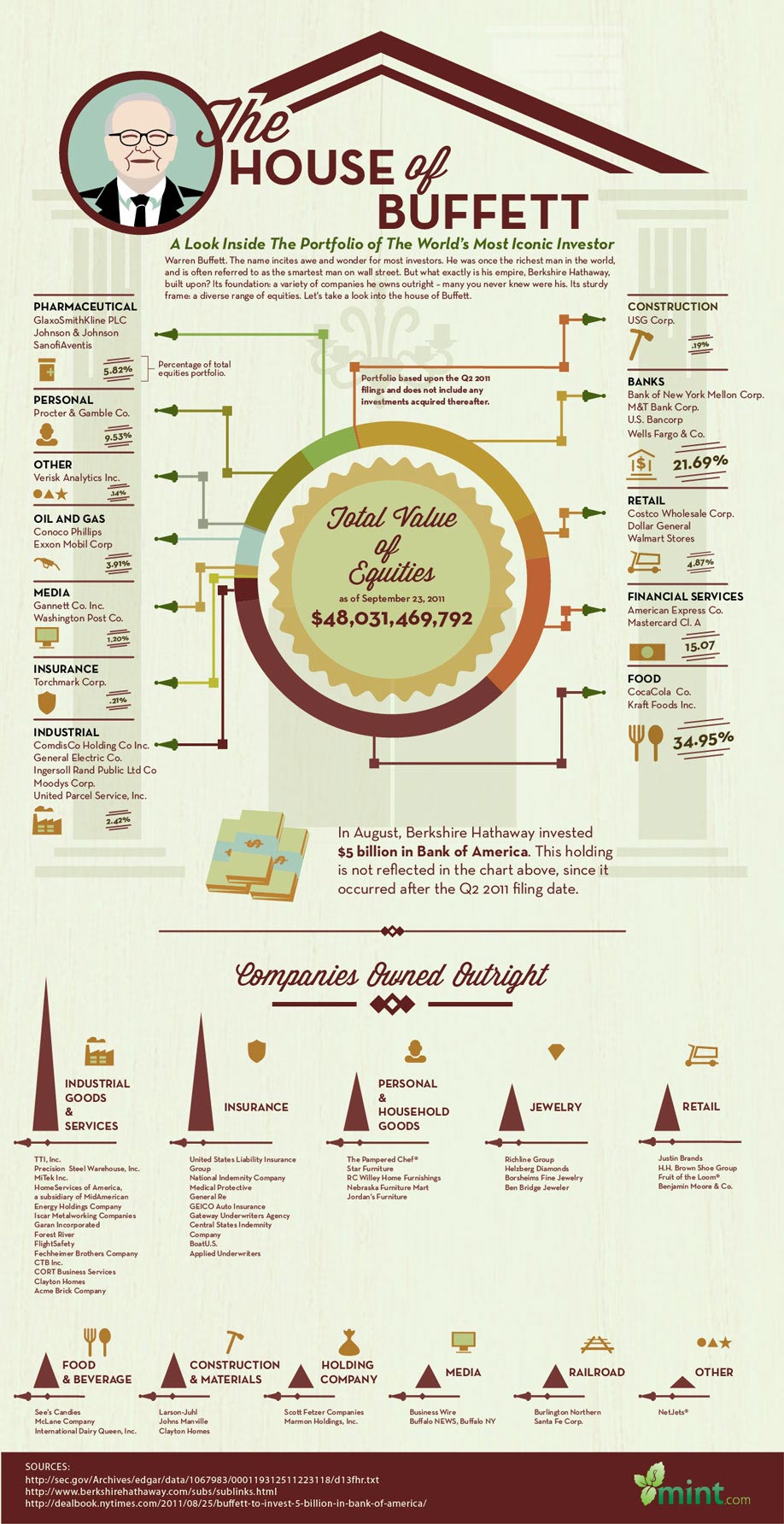

Warren Buffett is an American business magnate, investor, and philanthropist. He is widely regarded as one of the most successful investors in the world. Often introduced as “legendary investor, Warren Buffett“, he is the primary shareholder, chairman and CEO of Berkshire Hathaway.

This infographic done with Mint, looks at what his empire, Berkshire Hathaway, is built upon.

Source: https://www.sociableblog.com/2011/10/09/the-wealth-of-warren-buffett

Source: https://www.sociableblog.com/2011/10/09/the-wealth-of-warren-buffett

These days everyone from marketers to designers, bloggers and video producers dream of “going viral.” Everyone wants to be the next Charlie Bit My Finger or Old Spice guy. But striking it viral can be difficult. There’s no exact recipe or formula and going viral requires luck (and frequently money as well), but ProBlogger has done a little research and asserts that, even if you can’t guarantee virality, understanding the key components of what makes content go viral can help you ensure that your great content gets “the attention it deserves.”

Business loans, angel investors and venture capitalists — in many cases, these three entities are determining the success or failure of small businesses across the country.

This graphic takes a deep look at each source of capital, have uncovered how much money is going where, and identified common considerations, compromises and benefits of each. In the end, this gives a good visual look at the state of business financing in today’s economy.

Source: https://www.lendio.com/blog/visual-funding-infographic/

As the head of Angel Investment Network, I’ve had the chance to speak with a lot of angels over the years. When discussing their experiences, some things kept coming up again and again…

1) Not looking at enough deals

Make sure you look at as many investment opportunities as possible. The more business plans you read, the more likely you are to find the one that pushes all the right buttons. It also lets you notice industry trends and see if any competitors and emerging. Last year I read about 50 plans about wind turbines, who all claimed to be the best. You quickly realize that there are so many new players fighting for market share that it would be a very difficult call to make in terms of making an investment. Professional venture capitalists expect to look at 100 companies for every investment they make, so you should join several angel groups to make sure you see as many deals as possible.

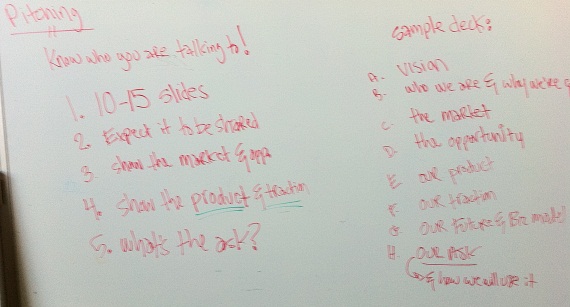

A picture from the white board at Ryan Spoon’s presentation on creating early stage pitch decks (primarily focused on the seed round).

Please take this for what it’s worth: just one investor’s opinion. As is true with everything – the best answer is “it depends”. It depends on your background, your company, your raise, and your audience.

Please take this for what it’s worth: just one investor’s opinion. As is true with everything – the best answer is “it depends”. It depends on your background, your company, your raise, and your audience.