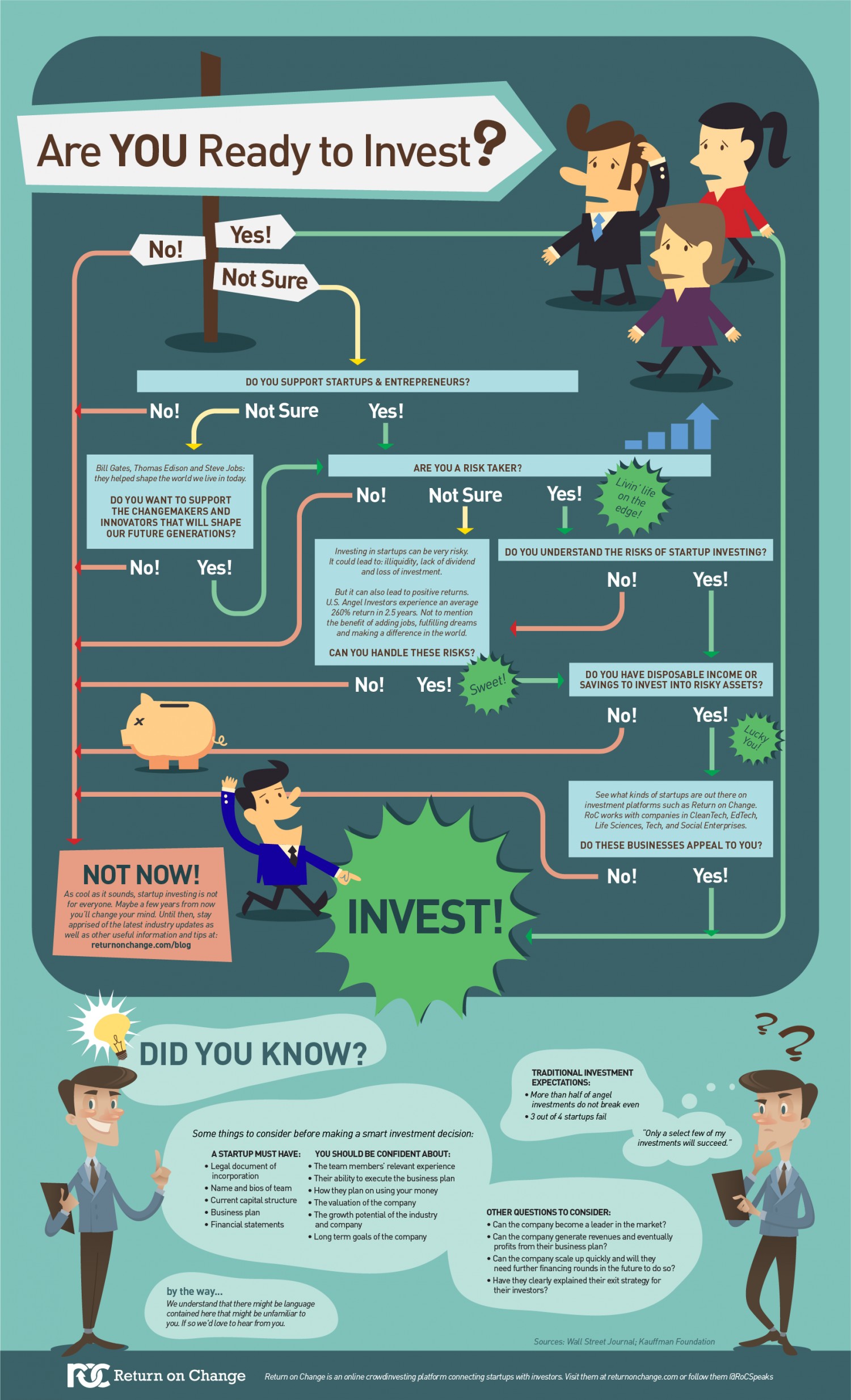

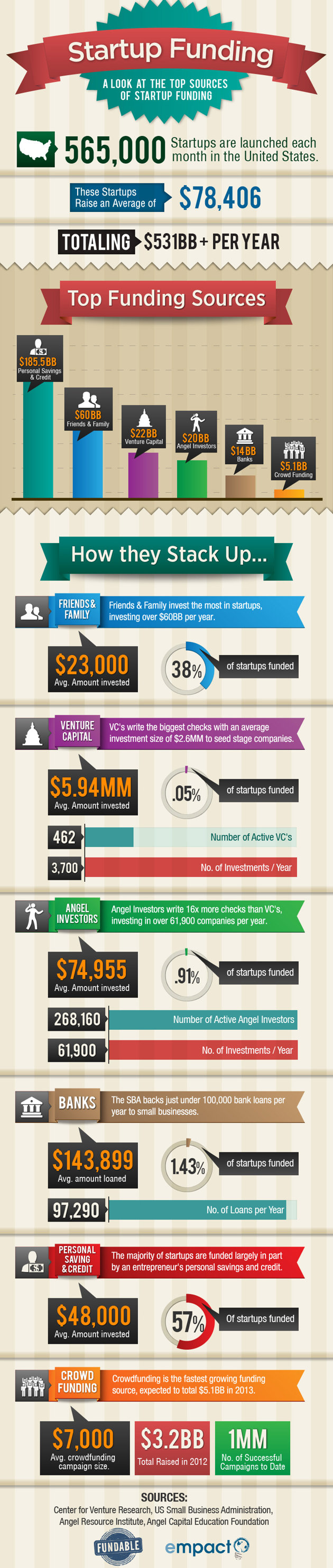

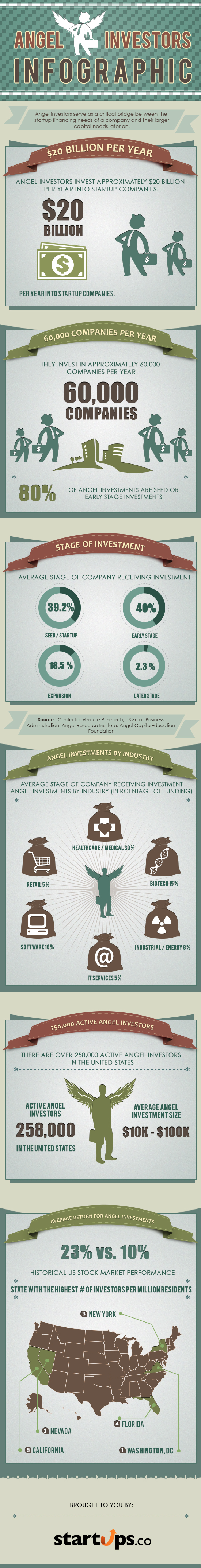

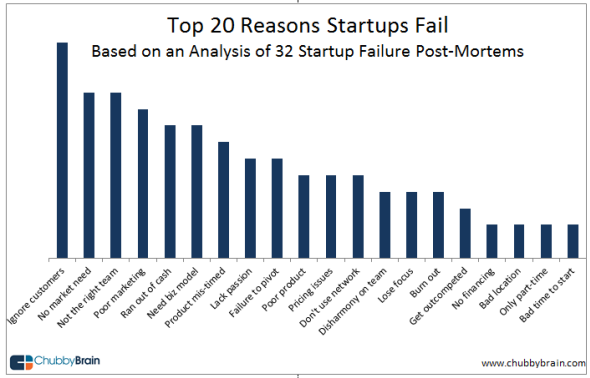

If you are an entrepreneur seeking funding for a new business, there are a number of funding sources available for consideration. However, not all funding options may be suitable for you. When determining which type of funding is most appropriate, it is important to determine how much control you are willing to give up and what sort of payment schedules are realistic for your new venture. Although many entrepreneurs are hesitant to give up partial control of their new business, angel investors are a smart way to raise capital quickly.

Angels versus Banks

Angel investors can offer on-going support, management expertise, and badly needed capital. However, it is important to acknowledge that these investors will inevitably want to control aspects of the company in exchange for their money. It’s not necessarily a bad thing as these people are typically highly skilled in business with valuable advice to offer. As investors will be seeking a portion of the profits, they will need to protect their investment as well as yours. But as Forbes magazine suggests, this is one of the most difficult decisions an entrepreneur must make.

Business loans are appropriate for those who do not want to give up any control of their business. However, you will need to begin paying back your loan much sooner than if you were partnered with an angel investor. Furthermore, there is much more flexibility with an angel investor to reach favorable terms where as it may be a much larger challenge to convince a bank to offer a better rate. The key benefit of angel investors is that they understand the importance of keeping money in a business during the start-up months and they will not typically seek any remittance until the business is profitable. To learn more about current loan rates, check this blog post explaining why ‘good’ payday loans still very expensive.

Sometimes you may find yourself in a position of difficulty where you may need extra cash. Whether that’s for an overdue bill, car expenses, personal reasons, or an extra sum to pay for some much-needed home improvements. Good credit, or bad.

Control versus Expertise

Angel investors commonly fund high growth companies in exchange for an equity position. As there can be great risk involved, most investors are not satisfied with moderate success. In many cases, they want at least a twenty percent annual return. As an entrepreneur, it is important that you approach angel investors with a realistic mindset. It may be easier to get money out of a bank rather than an angel as most entrepreneurial businesses will not generate the level of returns desired by the investors without giving up significant equity. However, it is also important to understand that angel investors are also experts in their fields with extensive managerial experience which can provide tremendous value to entrepreneurs.

The mental value of investors found in their networks, experience, and expertise is equally as important as their financial investment. Angels will want to be involved in the business but that can work to your advantage as they are agents of the business that can bring in expertise, sales, and contacts. If you have the privilege of choosing among a variety of angels, it is most practical to select one with proven experience in the industry of your business.

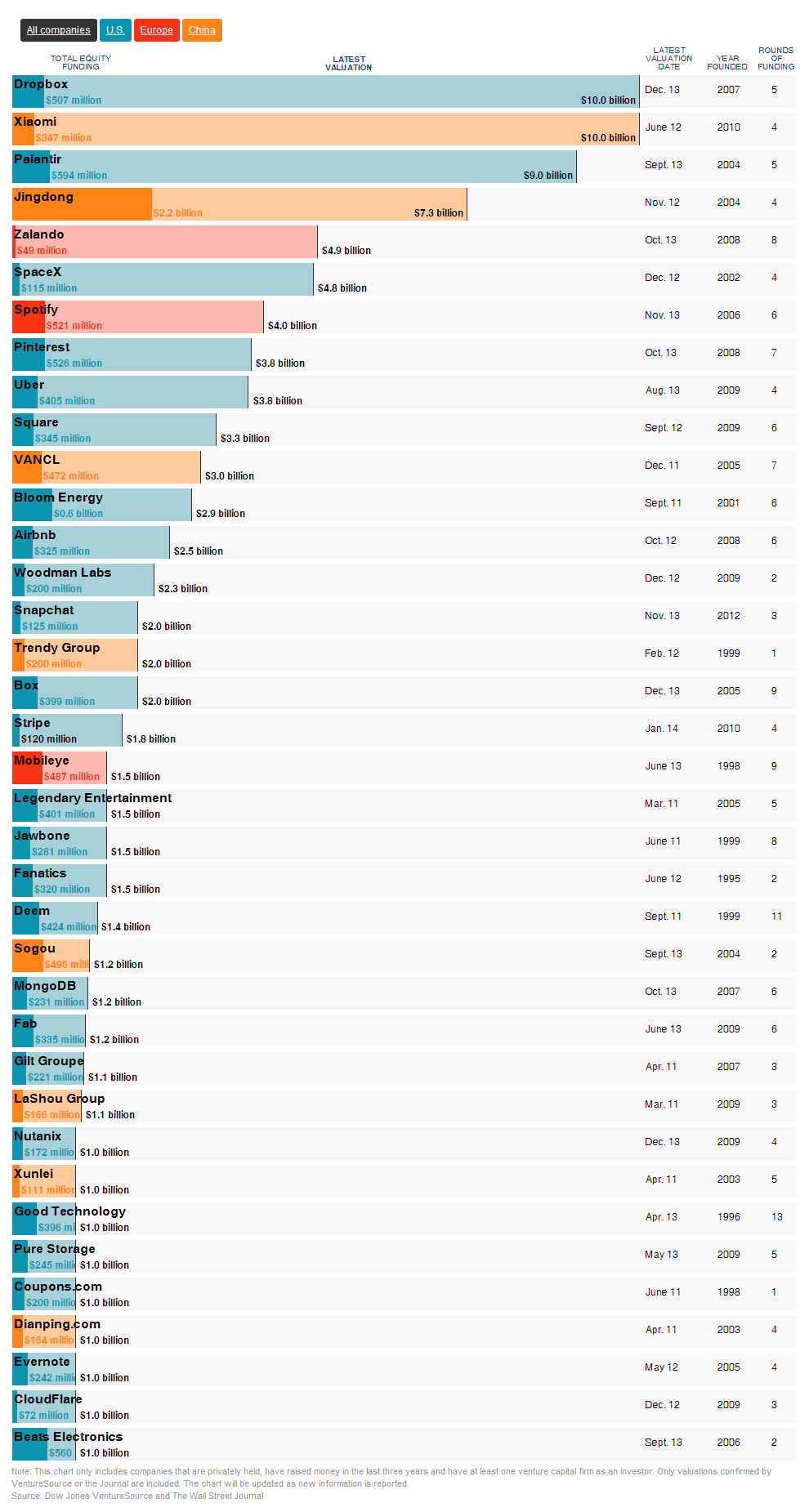

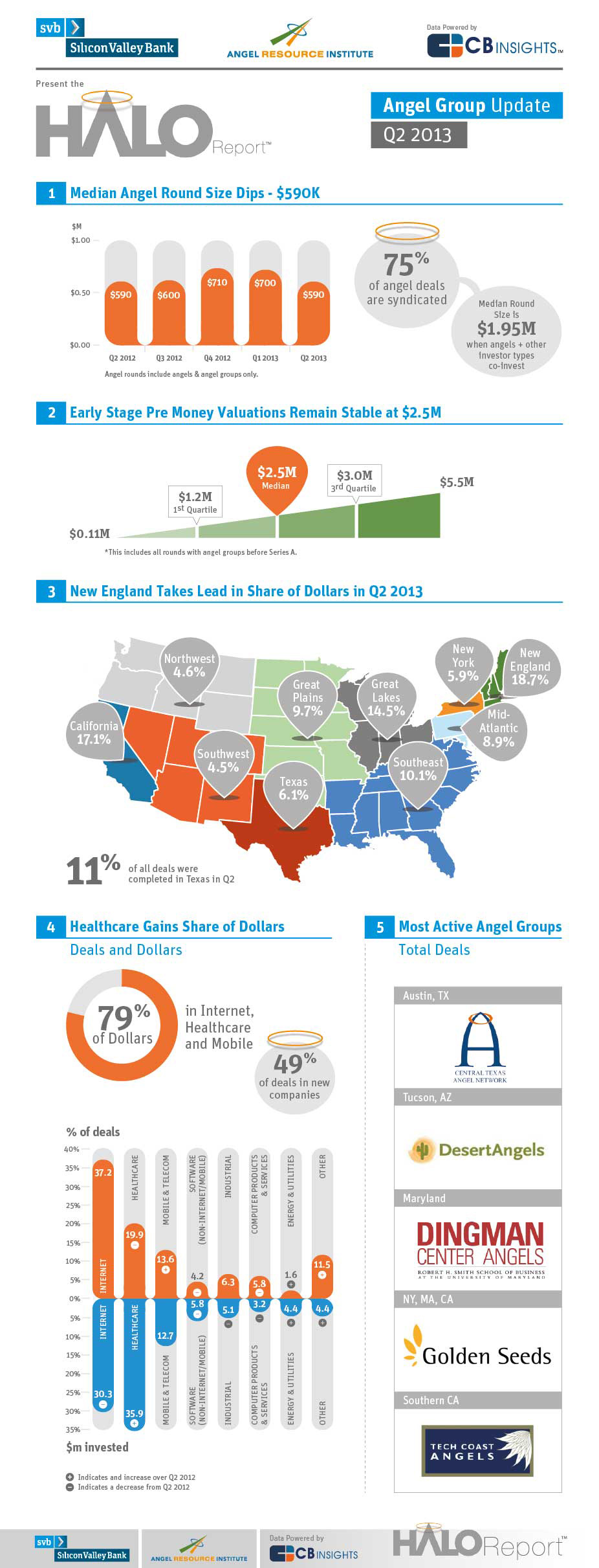

Everyone Needs a Realistic Return on Investment

Angels are most often drawn to companies that can benefit from increased government spending. New companies in infrastructure, health care, energy, or technology often do well. By doing your homework and research in advance, entrepreneurs can determine if their business is suitable for angel investors. If an entrepreneur approaches an angel investor with an outrageous company valuation or unrealistic equity proposal, it will be a waste of time for all stakeholders. However, that doesn’t mean that an entrepreneur should give their business away just to attract an angel investor. It is equally important for the entrepreneur to get a full return on their investment as well. It is wise to value your company at a realistic level to prevent a prospective investor from jumping to the conclusion that they need to justify their investment with means beyond the equity stake. But investors don’t just evaluate the financial aspects or number crunching either. As Entrepreneur magazine reports, angels like to invest in people rather than products.

Benefits of Equity Financing

Funding your business through an equity financing model with an angel investor enables entrepreneurs to cut the bank out of the picture. Rather than spending badly needed cash on loan repayments, entrepreneurs can use the money to continue growing the business. While angel investors may be hard to get, one key benefit is that if the business fails, you are not required to return their original investment which minimises risk to the entrepreneur and eliminates any burden of debt. With banks, you are always required to pay back any loans regardless if the business succeeds or fails. Equity investment is a long-term partnership that involves the investment of not only cash but experience into a new business. It is always important to remember that in the challenging early days of your business, angel investors can offer valuable business advice and assistance that you may not be able to obtain from banks, friends, or family.

Striking the Right Deal with the Right Partner

In certain cases, entrepreneurs may not be partnered with a single angel investor but rather an angel group that involves multiple investors. Angel investments are highly suitable for businesses that are already established beyond the risky start-up period but may need additional capital to expand. Always choose an investor that you believe can provide the right mentorship. When their money is on the line, they are equally motivated to ensure that the business succeeds. Angel groups are often easier to find while individual investors are most commonly found through networking. Angel investors like to see entrepreneurs who also invest some of their own capital in their business. The angel financing industry is huge around the world. In the United Kingdom alone, it is estimated that approximately 18,000 angels invest nearly £850 million annually, according to the UK Business Angels Association. However, in the event that you fail to strike an equity deal with an angel investor, that doesn’t mean that you can’t strike any deal with them. In some cases, investors may not be willing to accept an equity proposition but they may be willing to offer a private business loan independent of any banks. These are beneficial as the terms can be much more flexible. As UK website Money reports, peer to peer business loans can often result in lower borrowing rates for entrepreneurs than those offered by banks and better access to credit is available than through traditional channels.

Whether you work with a group of angel investors or a single investor, finding the right partner is critical to the success of your business. It is important to identify one with a vision that synergises with your own. Conflicting interests can be a disaster not only to your relationship but to the business as well. Never jump at the first offer of cash as the deal must always be mutually beneficial.

This article was written by Evelyn Millachip.