Author: mikelebus

Infographic: A Visual Look at Funding — Comparing Equity vs Debt Financing

Business loans, angel investors and venture capitalists — in many cases, these three entities are determining the success or failure of small businesses across the country.

This graphic takes a deep look at each source of capital, have uncovered how much money is going where, and identified common considerations, compromises and benefits of each. In the end, this gives a good visual look at the state of business financing in today’s economy.

Source: https://www.lendio.com/blog/visual-funding-infographic/

Infographic: How Small Businesses Are Using Social Media

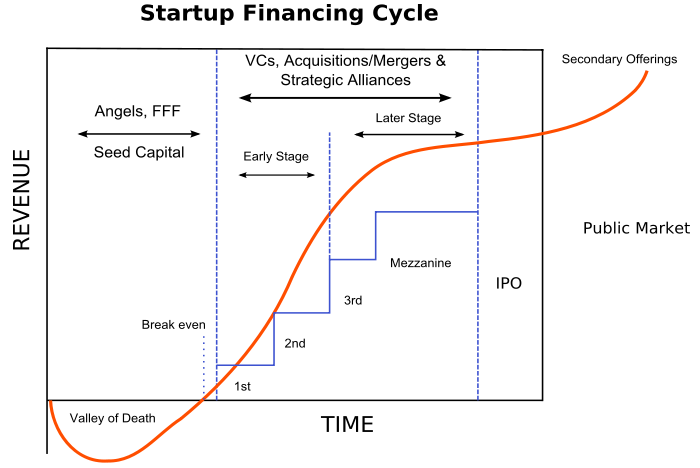

Chart – The Startup Financing Cycle

Tips from Angel investors at Rock Health 2 of 2

7 Common Mistakes Made by Angel Investors

As the head of Angel Investment Network, I’ve had the chance to speak with a lot of angels over the years. When discussing their experiences, some things kept coming up again and again…

1) Not looking at enough deals

Make sure you look at as many investment opportunities as possible. The more business plans you read, the more likely you are to find the one that pushes all the right buttons. It also lets you notice industry trends and see if any competitors and emerging. Last year I read about 50 plans about wind turbines, who all claimed to be the best. You quickly realize that there are so many new players fighting for market share that it would be a very difficult call to make in terms of making an investment. Professional venture capitalists expect to look at 100 companies for every investment they make, so you should join several angel groups to make sure you see as many deals as possible.

2) Not making enough investments

The Rule of 12 says that you need to invest in 12 companies to have statistical diversity. Invest in fewer than 12 deals and you run the risk of them all failing. Investing in a startup is very high risk, so it’s much more advisable to invest £20,000 in 5 companies than £100,000 in one company. Ron Conway says 1/3 of the startups in your portfolio will lose, 1/3 will get you your money back and 1/3 will be wins. This shows how important it is to diversify your portfolio as much as possible to increase your chances of picking a hit.

3) Not knowing when to quit

I don’t want to make too close a comparison to gambling, but angels need to have the same mentality as gamblers when things don’t go well. In the same way that a gambler needs to know when to walk out of the casino when things aren’t going their way, an angel needs to know when to throw in the towel and let an investment go out of business.

4) Expecting a quick return

Most entrepreneurs’ business plans say they expect to exit within 3-4 years, but the reality is that it usually takes much longer than that. Angel investing is a long-term commitment, so it’s important to invest money that you can afford to be without for a number of years.

5) Not doing thorough due diligence.

As with any business deal, it’s important to do through due diligence on the business and management team. You’ll more than likely be giving your money to a complete stranger so you need to trust them completely and feel comfortable that they’ll spend your money wisely.

6) Not reserving additional capital for the inevitable follow-on round.

The initial investment won’t last forever and most companies will have to raise more capital (either from existing investors, external angels or VC’s). If you invest in the next round of funding, it’s easier for you to set the company valuation. By participating in the follow-on round, the entrepreneur can go to the VC’s and say we’ve already raised X in this round in return for Y% equity, which values the company at Z. If not, you essentially lose control in that round and the VC’s are in a very strong position to dictate the terms of the deal.

7) Following a herd mentality

A lot of investors like to invest in groups as they get the added benefit of other investors’ expertise, contacts, etc. They feel their pooled experience should give the company (and therefore their own investment). This is often the case, but I’d remind investors not to place too much trust in other angels’ judgement and to always do their own diligence and research.

There are many ways to avoid these common pitfalls. Joining an angel network is a good way to see more potential investment opportunities, build a portfolio, and find out about other angels’ experience with investing (you may be able to learn from their mistakes).

Investors, are there any other mistakes you’ve made over the years? Add your thoughts below so other angels can have a much better shot at taking advantage of the great potential returns start-ups can provide.

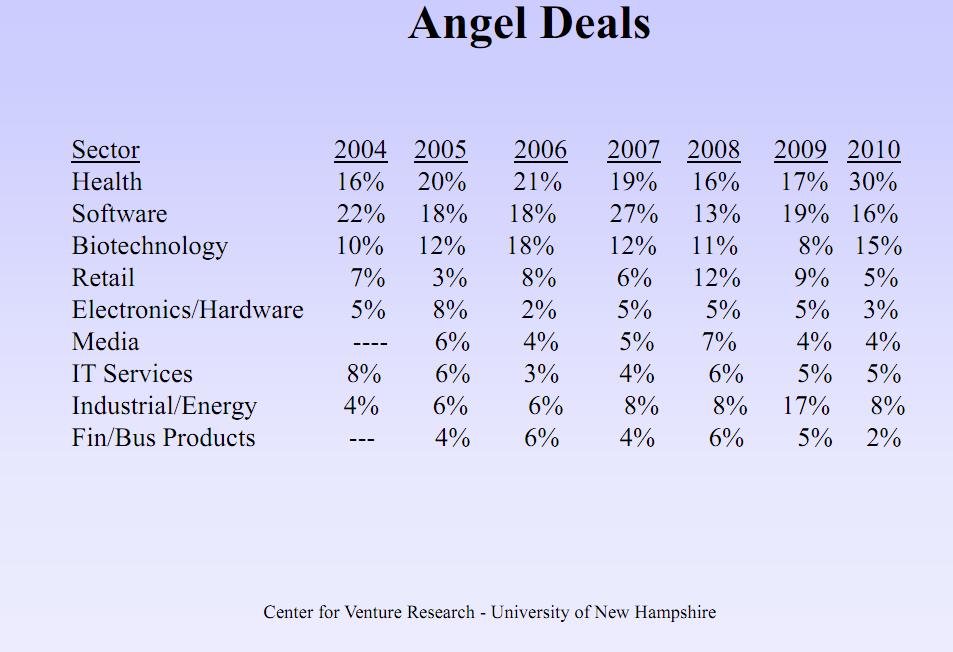

A snapshot of which industries US angels have been investing since 2004

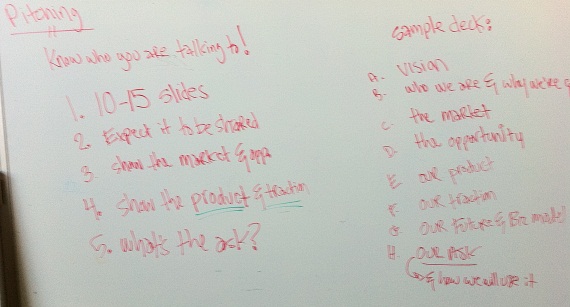

Creating an Early Stage Pitch Deck

A picture from the white board at Ryan Spoon’s presentation on creating early stage pitch decks (primarily focused on the seed round).

Please take this for what it’s worth: just one investor’s opinion. As is true with everything – the best answer is “it depends”. It depends on your background, your company, your raise, and your audience.

Please take this for what it’s worth: just one investor’s opinion. As is true with everything – the best answer is “it depends”. It depends on your background, your company, your raise, and your audience.

50 Quick Tips on Raising Angel Funding – Part 2

- Avoid general statements, such as “We will provide excellent customer service” or “I am very hard working”. Everyone could make these claims.

- Do due diligence on any investor you’re thinking of doing a deal with.

- Try to target angel investors with experience in their industry – their expertise will be invaluable.

- Expect the angels to want an active day-to-day role to share advice, knowledge & expertise.

- Ask for a non-disclosure agreement to be signed if there is any information you feel uncomfortable disclosing to the investor.

- Remember no legitimate investor will ask you to pay money.

- Be completely open from the beginning. If an investor finds a skeleton in your closet, the deal will be off.

- A market with high growth potential is very attractive to investor.

- Start your pitch with “a hook” – a statement or question that grabs the investors’ attention and makes them want to hear more.

- Don’t write “No Competition”. There is always competition, even if it is indirect competition.

- Be enthusiastic – Investors expect energy and dedication from entrepreneurs.

- Don’t use acronyms – people outside the industry won’t know what they mean.

- Gestures, body language (e.g. nodding and smiling) and confidence are very important when you’re speaking to investors.

- Ask family, friends and colleagues for feedback about your business plan and pitch.

- The more you practice your pitch, the more relaxed you’ll be when you’re in front of the investors.

- It’s really worth spending money on a good lawyer.

- Don’t be afraid to admit your weaknesses and admit you may need help in certain areas or strengthen part of your team.

- Use short paragraphs, bullets and lists: This makes it easier and quicker for the investors to read.

- Don’t write “Guaranteed Return”. No return is guaranteed!

- Check your business plan for spelling and grammatical errors they make you look unprofessional.

- Don’t say “My projections are conservative”. 90% of companies say the same thing.

- Make sure you have legit market research to back up your claims about market size and competition.

- If applicable, investors will want to see that you have the necessary patents and protection in place.

- Don’t say “We only need a 1% marketshare to have a turnover of 1 million” – financial projections don’t work like that.

- Last but certainly not least (here comes the sales bit), visit www.angelinvestmentnetwork.co.uk if you need any help raising funds. In the top right corner, you’ll find a drop-down list of all our networks around the world.