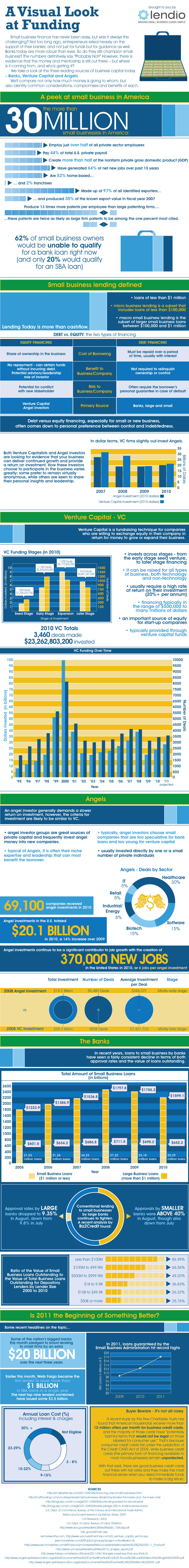

Business loans, angel investors and venture capitalists – in many cases, these three entities are determining the success or failure of small businesses across the country. This graphic from Lendio takes a deep look at each source of capital, uncovers how much money is going where, and identifies common considerations, compromises and benefits of each. In the end, this gives a good visual look at the state of business financing in today’s economy.

Author: mikelebus

A bit of light-hearted investor fun!

Video – Google Shows Startups How to Master SEO in 10 Minutes

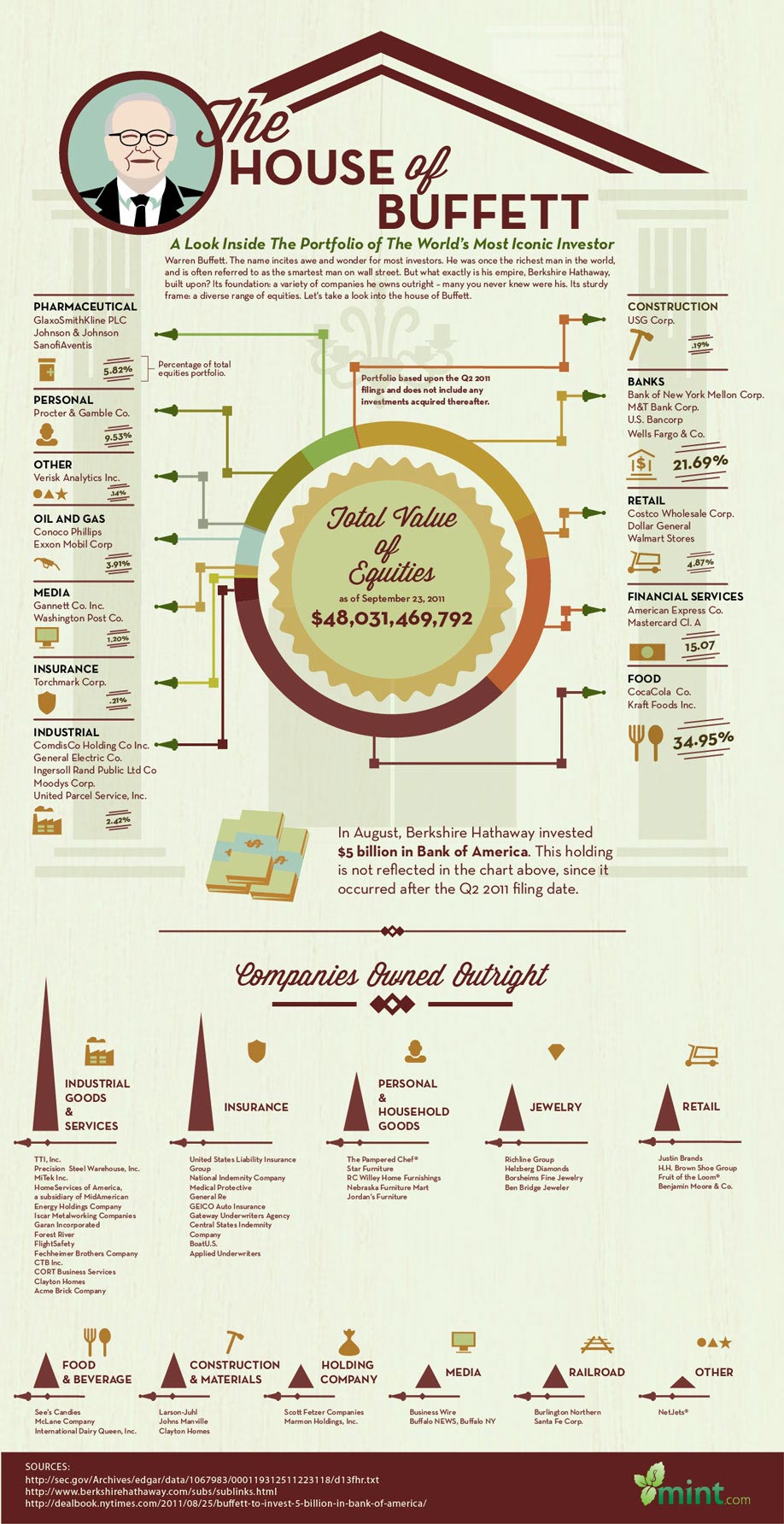

Infographic: Warren Buffett: Financial Genius – Inside the mind of the world’s 3rd richest person

Ever wonder who the richest people in the world are? Carlos Smith is number one, coming in at a $69 billion net worth, followed by Bill Gates, who comes in at $61 billion worth, and then there’s Warren Buffett, who has a fortune valued at $44 billion. That’s just crazy amounts of money.

Ever wonder what it’s like to be one of these guys? TrustableGold.Com did, and they did something about it too. They bring us this next infographic which is loaded with all sorts of personal and interesting facts about the Chairman & CEO of Berkshire Hathaway and legendary genius investor, Warren Buffet.

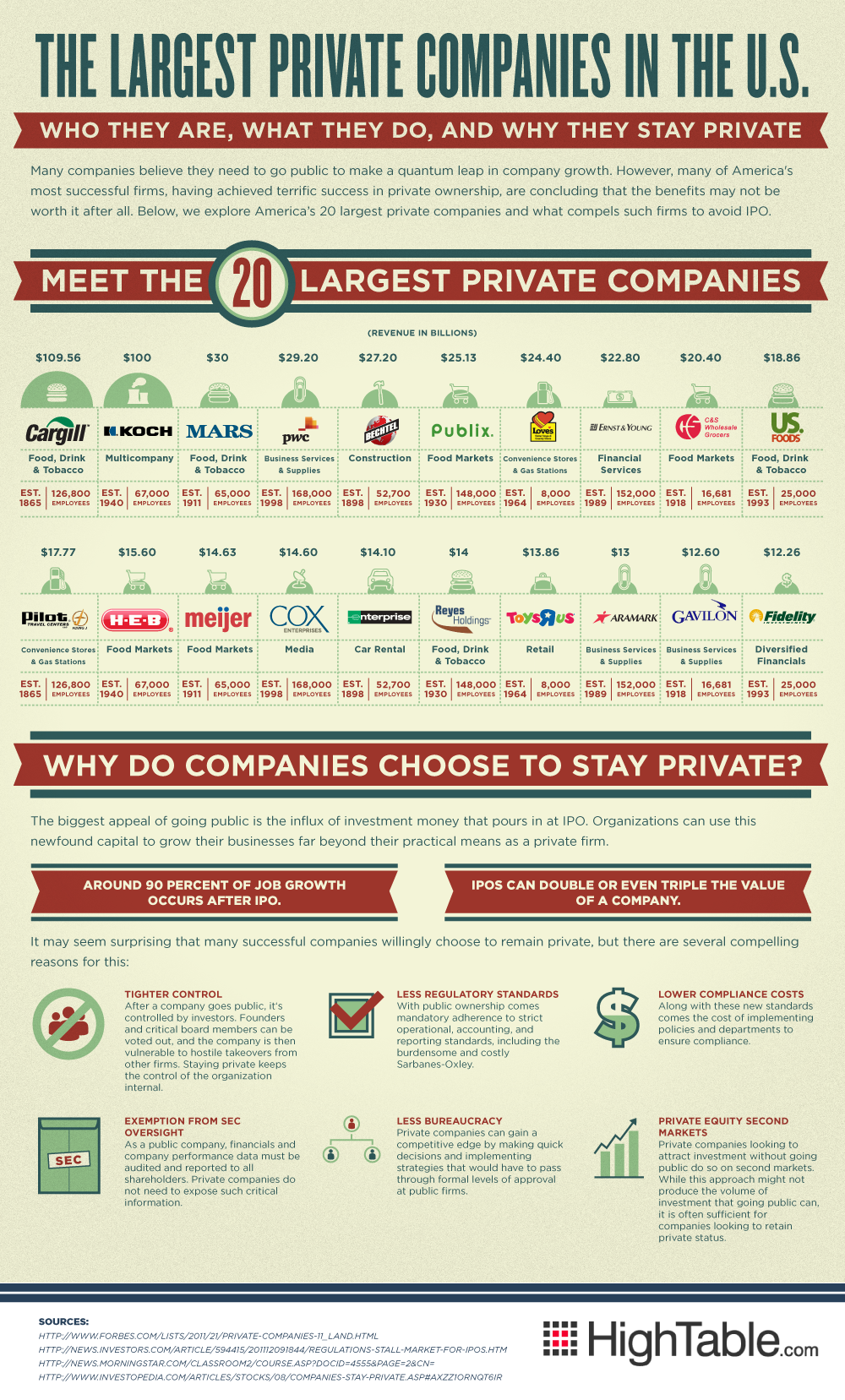

Interesting Private and IPO infographic – The Largest Private Companies in the US

Rock The Post has done some research in order to give you their top 50 angel investors

1. Aaron Patzer – Hailing from San Fransisco Aaron has invested in such ventures as BizeeBee, Topicmarks, Capire Micro Motors and HealthTap.

2. Adeo Ressi – As the founder of the VC-rating site “The Funded” Ressi is a powerhouse in the business world.

3. Andrea Zurek – Andrea has over 16 years of experience in sales and sales management. She co-founded the XG Ventures.

4. Andy Bechtolsheim – The cofounder of Sun Microsystems this man is at the top of the angel investing world. It seems everything he touches turns to gold.

5. Aydin Senkut – This angel investor doesn’t seem to know how to slow down but it pays off. He has invested in multiple startups to include Azumio, Baby.com.br, Clearslide, Chloe & Isabel, Imageshack, Justin.tv, and many more.

6. Babak Nivi – As the founder of Venture Hacks this MIT graduate is on top of his game when it comes to investing in successful startups.

7. Ben Ling – As a Product Manager Director of Search Products for Google Ling invests in 6-10 startups a year at roughly $25-100K.

8. Bill Joy – One of the co-founders of Sun Microsystems, Bill is seen as a powerhouse in the investing world. He is currently a partner at Kleiner Perkins Caufield & Byers.

9. Brett Bullington – Brett Bullington is an advisor at Outfit7 Ltd as well as a board member for Digg and Carolina for Kibera.

10. Brian Pokorny – Brian is an angel investor in Twitter, Square, and Tweetdeck to name a few.

11. Caterina Fake – The co-founder of Flickr and Hunch, Caterina is also the chairman of the board at for the popular online Etsy. She loves to focus on social software when investing.

12. Chris Dixon – Chris is the co-founder of Founder Collective as well as the CEO of Hunch. His investment portfolio includes Skype, TrialPay, DocVerse and many more.

13. Chris Sacca – Chris is a force to be reckoned with in the investing world. His investments have included Twitter, Bit.ly, Formspring and more.

14. Dave Duffield –As the co-founder and former chairman of PeopleSoft he has invested in startups that have included HireRight and Guru.com.

15. Dave McClure – Dave’s investments have included Mint, SlideShare, and Twilio to name a few.

16. Dave Morin – Dave was one of the co-inventors of Facebook Platform and Facebook Connect. He was also named #74 on the Silicon Valley 100 by Business Insider.

17. David Lee – David is the co-founder of XG Ventures. Some of his investments have included Posterous, Twitter, Facebook and many more.

18. Eric Shmidt – Scmidt is an executive chairman of Google and he has invested in startups to include Citizen Effect, PublishOne, and Sendmail.

19. Esther Dyson – Esther likes to focus on technology related investments and has invested in Space Adventures/Zero G, Coastal Aviation Software and Airship Ventures.

20. Jason Calacanis – Jason is the CEO and Founder of Mahalo, Inc., and has invested in startups like JIBE.

21. Jawed Karim – Karim is the co-founder of YouTube. In addition he was one of the first engineers at PayPal.

22. Jeremy Stoppelman – Jeremy is the co-founder and CEO of Yelp and was formerly the VP of engineering at PayPal.

23. Joe Kraus – A partner at Google Ventures, he co-founded Excite.com and JotSpot and invested in LinkedIn.

24. Josh Kopelman – The Managing Director of First Round Capital as well as the director of the board at Swipely and a few other companies.

25. Keith Rabois – COO at Square as well as on the board of directors of Yelp, Xoom and other companies. Invested early on in YouTube and LinkedIn.

26. Kevin Hartz – The co-founder of Eventbrite, Xoom Corporation and ConnectGroup. He also invested in PayPal, Geni.com, Friendster, Flixster.com, Trulia, Pinterest and Airbnb.

27. Kevin Rose – Co-Founder and CEO of Milk as well as the founder of Digg.

28. Larry Braitman – A founding investor in Flixster.

29. Lauren Flanagan – Co-founder of the Phenomenelle Angels Fund I, LP.

30. Manu Kumar – Founder of K9 Ventures as well as the founder of SneakerLabs, Inc.

31. Marc Andreesen – Co-founder and general partner of Andreessen Horowitz as well as co-founder and chairman of Ning. He has invested in Digg and Twitter.

32. Marc Benioff – Chairman & CEO of salesforce.com.

33. Mark Sugarman – Managing partner at MHS Capital and he has invested in Simply Measured, Venturebeat, and Pulpo Media to name a few.

34. Martin Varsavsky – Founded two telecommunications companies Viatel and Jazztel.

35. Max Levchin – Founder and CEO of Slide he also serves as chairman Yelp. He was also co-founder and CTO of PayPal.

36. Michael Dearing – Founder of Harrison Metal and has held leadership positions at Brain & Company, the Walt Disney Company, and Industrial Shoe Warehouse.

37. Mike Maples Jr. – A managing partner at Floodgaet, Maples was named as one of “8 Rising VC Stars” by Fortune Magazine.

38. Mitch Kapor – The founder of Lotus Development Corp as well as designer of Lotus 1-2-3.

39. Naval Ravikant – Founder of AngelList and co-founder of Venture Hacks. He has invested in Twitter, FourSquare, DocVerse and more.

40. Paul Buchheit – Creator and lead developer of Gmail and co-founder of FriendFeed.

41. Paul Graham – A partner at Y Combinator. He has invested in Infinity Box, WebMynd, and AppJet.

42. Paul Martino – CEO and co-founder of Aggregate Knowledge. Paul has invested in Zynga, PayNearMe, and TubeMogul.

43. Peter Fenton – A general partner at Benchmark Capital. He has invested in SpringSource, Terracotta, Yelp, and DotCloud and many others.

44. Peter Thiel – President of Clarium Capital. He has made investments in Facebook Slide, LinkedIn, Friendster, Geni.com, Yelp and many more.

45. Ram Shriram – Founder and managing director at Sherpalo Ventures ; founding board member of Google and 247customer.com.

46. Reid Hoffman – Partner at Greylock and Co-Founder of LinkedIn. He has invested in Digg, Facebook, Flickr, Ning, Zynga and others.

47. Rick Thompson – Co-founder and chairman of Playdom. His investments include Udemy, Trooval, SocialShield, Tykoon and more.

48. Rob Hayes – Managing partner at First Round Capital. He has led investments in companies such as Mint.com, HomeRun, Uber, TaskRabbit, AppFog, Get Satisfaction, and DNAnexus.

49. Ron Conway – Founder and Managing Partner of the Angel Investors LP funds. Early investments included Google, PayPal, Digg, Pinterest, and many others.

50. Russ Fradin – CEO & co-founder at Dynamic Signal. Invested in Udemy, Humanoid, Colingo, Playdom and more.

“As an angel investor, revenue trumps no revenue,” says Jonathan Mellinger, successful entrepreneur and member at Robin Hood Ventures

Jonathan Melllinger has experience on both sides of the investment ecosystem, first as a successful entrepreneur and now as a member at Robin Hood Ventures.

Mellinger told an audience of entrepreneurs and angel investors at the Science Center’s Angel Education event that he uses instinct and experience to choose companies to invest in, but he also laid out his model for making early stage investments Tuesday.

The programming is part of an ongoing effort from the University City life sciences research park to broaden its mission and the awareness of regional investors to smaller, more consumer-facing ventures.

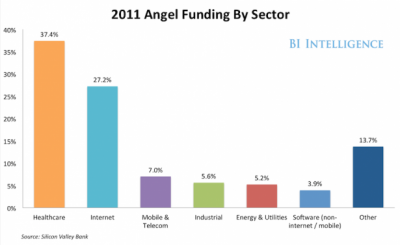

Here is the 2011 US Angel funding by industries, according to a new report by BI Intelligence

Infographic: 35 Startup Buzzwords Every Entrepreneur Should Know

Angel, freemium, MVP, value proposition — there are a lot of buzzwords that get thrown around in the startup world. As an entrepreneur, it’s your job to know, understand and sparingly use them.

Entitled “The Founder’s Dictionary,” and jammed packed with a ton of buzzwords I have heard in boardrooms and coffee shops, the infographic was created to uncover “the true meanings” of these terms.

Take this one with a grain — no, a tub — of salt, folks. This infographic isn’t what it seems to be at first sight. While it would be awesome to have a dictionary for these terms, this resource actually pokes fun at the mysterious origins and definitions of these oft-used buzzwords.

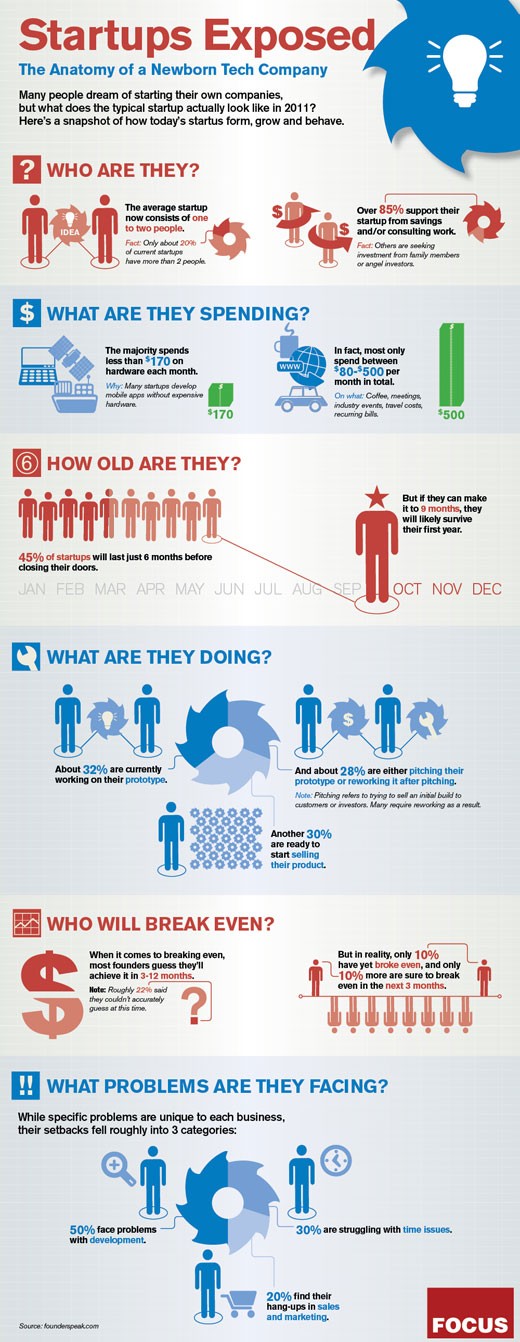

Infographic: Startups Exposed – The Anatomy of a Newborn Tech Company

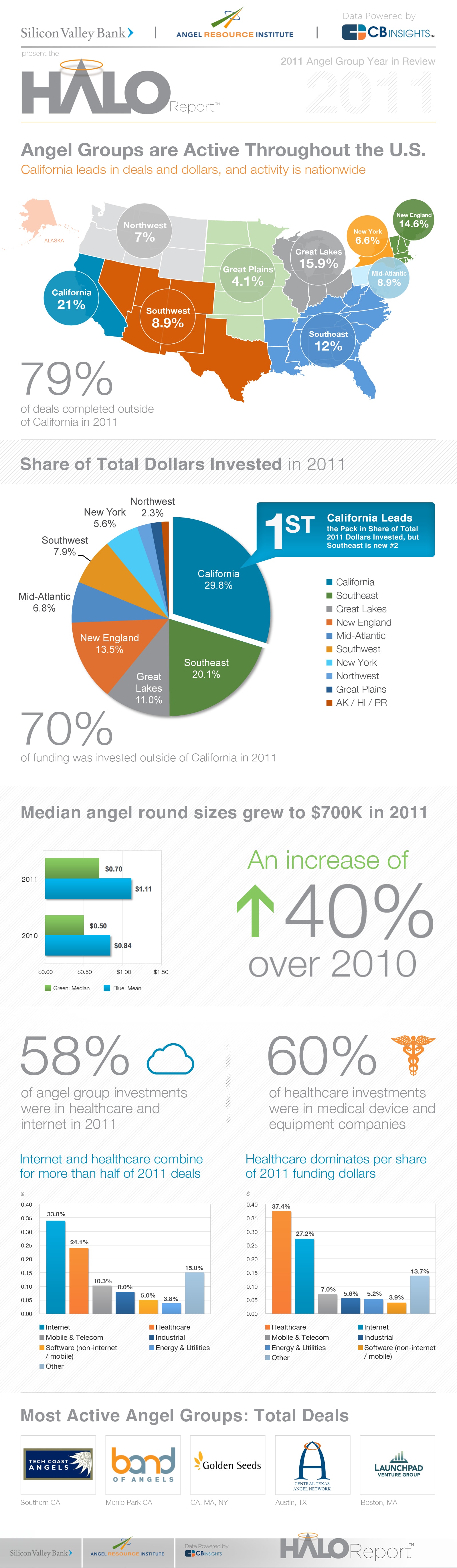

Infographic: Highlights of angel investment activity and trends in North America

The Angel Resource Institute (ARI), Silicon Valley Bank (SVB) and CB Insights today announced findings from the first Halo Report, a collaborative effort to raise awareness of early stage investment activities by angel investment groups. The research series highlights angel investment activity and trends in North America and provides much sought after data that has not been previously available to entrepreneurs or early stage investors.

Halo Report Highlights:

- Angel groups are active throughout the U.S. in 2011

- California leads in deals and dollars among individual states

- 79% of angel group investments were in companies outside of California

- 70% of total funding was invested outside of California

- Median angel group rounds size grew to $700,000, an increase of 40% over 2010

- 58% of angel group investments were in healthcare and internet companies

- 60% of healthcare investments were in medical device and equipment companies

- The most active angel groups were Tech Coast Angels, Band of Angels, Golden Seeds, Central Texas Angel Network and Launchpad Venture Group

Angel investors, those who invest their own funds and expertise directly into startup companies, appear to be taking on an increasingly important role in driving entrepreneurship throughout the United States. Their investments are in startups and young companies, which have been cited by the Kauffman Foundation as the key source of net new jobs in the country. Nationwide, these angel group investments have opened up new opportunities for centers of innovation and entrepreneurship. The Halo Report found that many deals are syndicated among investors. As a result, companies needing larger investments have access to the additional capital they need to grow their businesses.

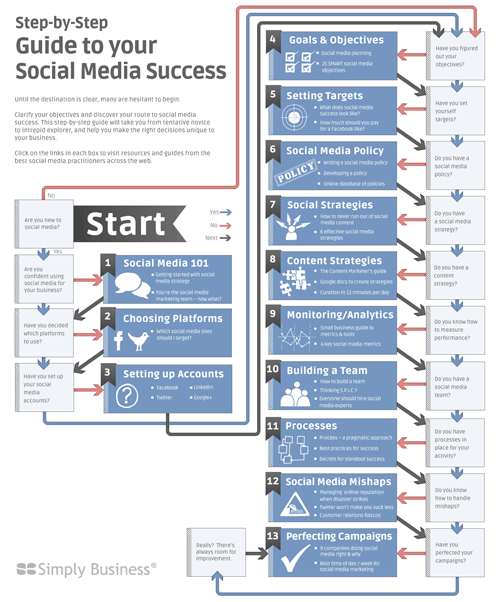

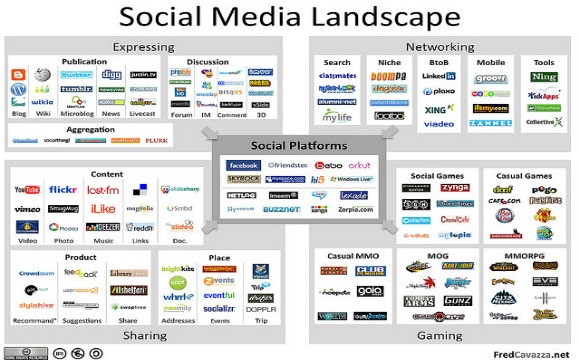

Infographic: How to Create a Social Media Campaign

Click this link for the full interactive version: https://www.simplybusiness.co.uk/microsites/guide-to-social-media-success/

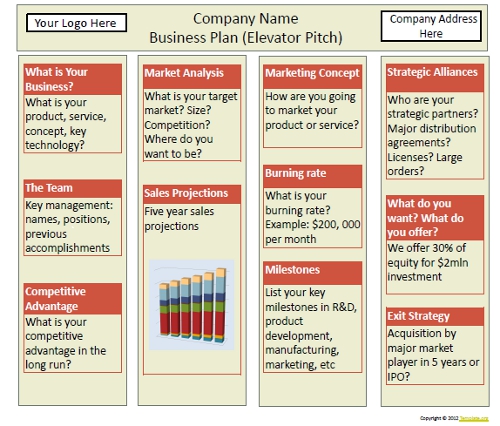

Business Plan (Elevator Pitch) Template

An elevator pitch is a short business plan used to quickly and simply define a business concept and the plan proposition. The “elevator pitch” reflects the notion that it should be possible to deliver the business plan to the potential investor in the time span of an elevator ride, or approximately thirty seconds to two minutes.

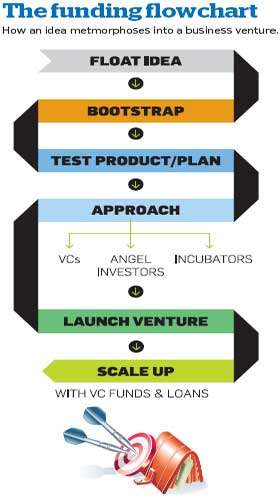

The Funding Flowchart. How an idea metamorphoses into a business venture

Infographic: Measuring the Business Impact of Social Media

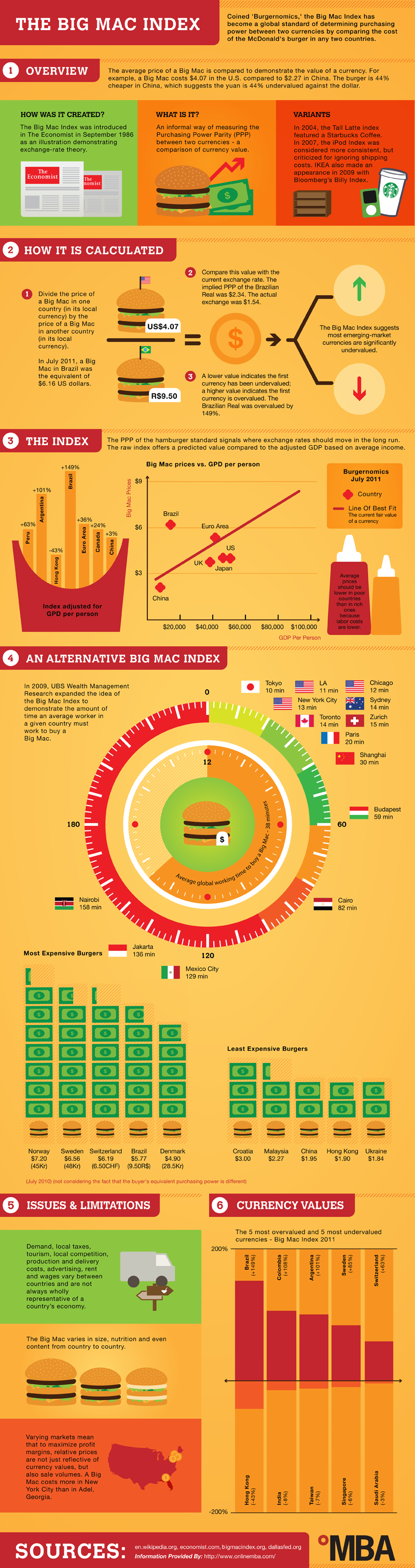

Infographic: How the Big Macs Stack Up – The Big Mac Index

Infographic: The Wealth of Warren Buffett, The Legendary Investor

Warren Buffett is an American business magnate, investor, and philanthropist. He is widely regarded as one of the most successful investors in the world. Often introduced as “legendary investor, Warren Buffett“, he is the primary shareholder, chairman and CEO of Berkshire Hathaway.

This infographic done with Mint, looks at what his empire, Berkshire Hathaway, is built upon.

Source: https://www.sociableblog.com/2011/10/09/the-wealth-of-warren-buffett

Source: https://www.sociableblog.com/2011/10/09/the-wealth-of-warren-buffett

Infographic: Why Does Content Go Viral and What Drives Us to Share It?

These days everyone from marketers to designers, bloggers and video producers dream of “going viral.” Everyone wants to be the next Charlie Bit My Finger or Old Spice guy. But striking it viral can be difficult. There’s no exact recipe or formula and going viral requires luck (and frequently money as well), but ProBlogger has done a little research and asserts that, even if you can’t guarantee virality, understanding the key components of what makes content go viral can help you ensure that your great content gets “the attention it deserves.”