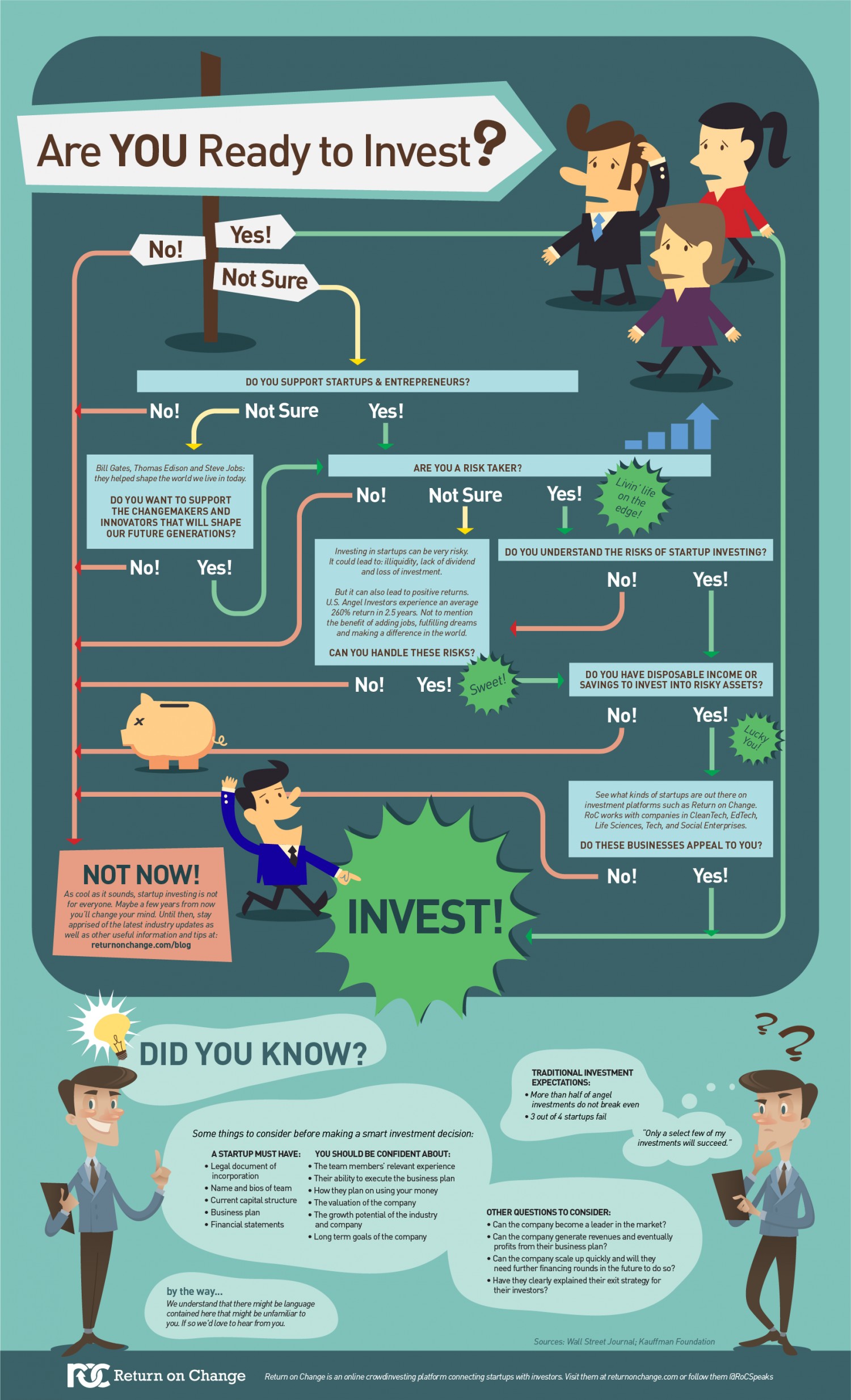

You have a powerful idea for the next big thing, but before you sell it to anyone, you have to get it all down on paper. It’s time to make a business plan. How do you know if you’re headed in the right direction? Washington State University created an infographic that provides 10 guidelines to help prospective entrepreneurs organize their thoughts and wow potential investors.

What’s your Number 1 business plan tip?