Wedo is a Neo-Bank set up for the freelance community by 5 times founder Indiana Gregg (Indy); in our latest #BehindTheRaise Indy shares her top tips for fundraising success:

Tell us about Wedo and how you came up with the idea

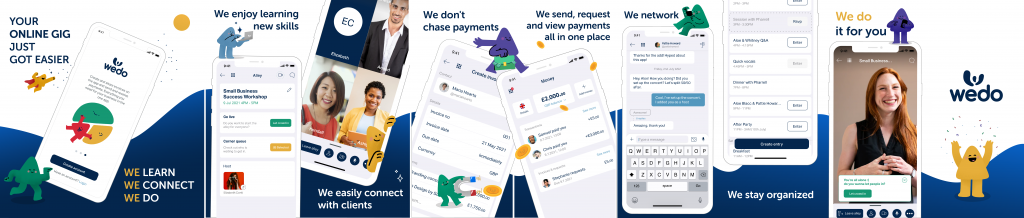

Wedo is the place to start or grow your online business: create live video and audio alleys, share content, take payments and send and receive money completely hassle-free.

I’m a 5x tech founder and have also run a digital media company where a lot of our gigs came from freelance sites. I had an exit five years ago and focused on learning everything there is to know about the freelance communities that were shooting up and getting tons of traction; so, I became a freelancer myself. It quickly occured to me that this rapidly growing piece of the global workforce would soon be in trouble. Freelancers pay to play. It’s not very cool. I couldn’t help but wonder if there was a more fair way to serve them with an ecosystem where they weren’t having as much as 20% of their earnings paid as commission fees. Wedo was the answer.

I started building a prototype at the beginning of COVID and by June, 2020, we had a team. The team bootstrapped for the first eight months and then I came onto the AIN to look for pre-seed investors at that point. We raised £515,000 on a £5M pre-money valuation early this year (2021) This allowed us to get regulatory coverage in the USA, UK and Europe to operate as a bank challenger and we built the SaaS technology MVP and began to private test users this spring.

We are a community with tools that help create the network freelancers need to connect with clients – They can onboard new clients and connect with existing ones by creating their own Alleys (these are video and audio conference rooms where they can discuss with clients, share files, take instant payments, send and receive invoices and bank seamlessly).

With Wedo, you can set up a payment link to your conference, consultation or subscription. The deposit goes directly into your Wedo account. You decide whether to use it to pay for something or to transfer it to another account.

Why did you decide to raise investment?

We raised investment in order to build the technology and acquire the partnerships and some of the tech rails we needed. We were also at a point where we needed to hire more people to fill skill sets we were short on. We are currently raising our Seed round again here on the AIN and it’s been epic! We’ve met a lot of amazing investors. We aim to close the round by the end of October.

What is your top tip for anyone raising investment for the first time?

Don’t raise money until you have thought through your business model and can communicate what you are building/creating or selling very succinctly. If investors don’t understand what you are aiming to achieve, it means you aren’t communicating the problem you solve properly yet.

Practice with people in your surroundings to see how you can improve your pitch and ask experts their opinion of your model, you projections and your deck to refine and develop it so that when it’s time to present your plan to investors, you are confident and they are confident that you will be persistent and hit a home run for the company. Investors are on your side. They want you to succeed and if they say no, ask for feedback. Sometimes it’s just not a match; however, oftentimes their advice and feedback can be invaluable.

What attracted investors to your company?

Our team is brilliant, the timing is right for the market opportunity,and our technology and business model is a first.

My biggest fundraising mistake was…

Oh boy. I probably have a lot of these. Raising investment is a learning curve over many years. However, probably introducing an idea too early before it has been baked and refined can be a time waster. Ideas are just ideas. When you begin to execute your idea, it becomes more real and you have an entire research and discovery period to go through prior to asking other people to invest in it. You also have to be fully invested yourself. If you aren’t and it’s too early, don’t go out to raise. Make sure you can validate your idea during each step of the fundraising rounds and you have KPIs and targets that you will hit with the capital that you raise.

Why did you choose to use Angel Investment Network?

I chose angel investment network because I’ve had great experience finding investors for my companies and other companies I’ve consulted in the past here on the AIN.

It’s a really big network and I love that you can search and really pinpoint investors who are most likely to be interested in the company you are building. There is an enormous spectrum of investors globally with varying interests and it’s a great way to connect.

Our number 1 focus for Wedo for the year ahead is:

Our number one focus will be penetrating the market heavily, we’re going after small businesses and freelancers who open accounts and use our services. We’ll continue refining our tech into full product/market fit, and customer retention. Wash, rinse and repeat! If you’re reading this now, please join us!

Keen to hear more?

If you would like to see what other companies are up to on Angel Investment Network, or are interested in raising funding yourself, you can find your local network here.