The Angel Investor’s playbook: 5 insights to winning funding

By Toby Hicks

As part of our ongoing commitment to the startup community, we regularly interview leading investors across our network to gauge the state of the current fundraising landscape. These experts evaluate countless pitches and have extensive collective experience in nurturing emerging companies.

Some clear themes emerged from this season’s investor interviews, such as the importance of trust in the ongoing investor-founder relationship, many entrepreneurs underestimating the level of preparation required, and the pressing need to truly identify an addressable market. Ideally one in which the founder has relevant experience.

Here are five top takeaways distilled from these recent conversations.

1. The importance of founder-investor alignment and trust

The relationship between a founder and an investor is far more than a simple financial transaction; it’s a partnership built on mutual understanding and shared goals. A strong rapport, underpinned by transparency and trust, is essential for navigating the inevitable challenges and celebrating the successes that come with building a startup.

According to Colin Boey, global investor and syndicate leader: “Integrity and mutual trust are essential. Founders need to be transparent about their business, challenges, and vision. Investors, in turn, should act as reliable partners – respecting confidentiality and providing support even during tough times.”

When founders and investors are aligned on the vision, values, and long-term objectives of the company, it creates a fertile ground for collaboration and growth. However without a solid foundation of trust, the partnership can become strained.

According to Hailey Eustace, founder of Commplicated: “Authenticity on both sides is very important as well as actually listening and respecting each other. It is a long-term relationship so it needs to be built on honesty and mutual understanding from the beginning.”

A relationship with a good angel investor could be a long lasting and profitable one. As Joanna Jensen, chair of the Enterprise Investment Scheme Association (EISA), and founder of Childs Farm puts it: “Your initial start up investors have taken a huge risk in backing you in the first instance. So be respectful towards them as your business grows and you look to obtain further investment.”

2. The need for thorough preparation in fundraising

Many founders, fueled by the passion for their idea, can underestimate the rigorous scrutiny they will face during the fundraising process. Investors aren’t just looking for a compelling product or service; they are meticulously evaluating the viability and scalability of the entire business.

Comprehensive due diligence is not a mere formality. It is a critical step for investors to assess the risks and potential returns.

According to Kelly Clifford, an experienced CFO turned angel investor: “Many founders underestimate the level of preparation required. Due diligence isn’t just a box-ticking exercise; investors want to see a well-thought-out business model, clear unit economics, and a compelling reason for their valuation.”

Founders need to move beyond the excitement of their idea and explain the granular details, demonstrating a sound business foundation. This need for meticulous preparation extends to understanding the fundraising process itself.

This was highlighted by Robin Leigh, a highly experienced private angel investor and deal structurer: “Startups need to be familiar with the details of the process, and therefore both how long it can take and that formal, quite detailed documents are required. This is mainly to reduce the risk of disagreement in future by ensuring that everyone has a clear common understanding about deal terms, rights and obligations on both sides, and general expectations.”

3) The indispensable role of a strong founding team

While a novel idea might be the initial spark for a startup, angel investors consistently emphasise the importance of the quality and capabilities of the founding team. A strong team possesses the resilience, adaptability, and expertise necessary to navigate the inevitable challenges of building a business and to effectively execute their vision.

Moreover, the team’s capacity to learn, take feedback, and work collaboratively is a critical factor in their assessment. Ultimately, investors are backing the people as much as the idea.

According to Phil McSweeney, angel investor and author of AngelThink: “Angel investors will look for certain key attributes in a founder – I usually flag determination, self-belief, courage and spirit as key.”

For Eustace, a blend of technical excellence and business acumen is key: “What hasn’t changed is that the founders I invest in have to be amazing; technically experienced and knowledgeable and within the top 10-20 people in their field. They also have to be commercially minded… It is definitely a red flag if they don’t talk about commercialisation.”

4. The critical importance of a sizeable and viable addressable market

Beyond the strength of the team, angel investors place significant emphasis on the potential of the addressable market. A large and growing market indicates the potential for significant scale and return on investment. Many talented teams with innovative products fall down when under interrogation the need for their solution is revealed to be limited or non-existent.

Therefore, demonstrating a deep understanding of the target audience, the size of the opportunity, and a viable strategy for capturing market share is crucial. This includes articulating not just who the customers are, but why now is the opportune moment to address their needs.

According to Boey, a key element he looks for is a founder’s ability to explain “why now is the right time to tackle this problem.” This highlights the importance of understanding market timing and trends. This perspective aligns with Kelly Clifford’s core criteria: “For me, it has always been about the team and the addressable market. A great team can pivot and navigate challenges, and a sizable market means there’s room for growth.”

5. The Importance of a clear vision and passion

Investors are also looking for founders who are deeply passionate about the problem they are solving and possess a compelling vision for the future. This intrinsic motivation and clear sense of purpose are often the driving forces that sustain founders through the inevitable hardships of building a business.

For Eustace the significance of this internal drive is key: “Follow your own vision and your own gut because when you start building a business for someone else it never works. You know your area and business the best.” Genuine belief in the problem being solved and the proposed solution is crucial for long-term commitment and success.

This sentiment is echoed by Boey, who emphasised the demanding nature of the startup journey. He advises, “The journey is a long struggle. Make sure you’re deeply passionate about the problem you’re solving, and surround yourself with a strong support network of early employees and investors.”

These interviews emphasise the multifaceted nature of securing early-stage funding. It is certainly not for the faint hearted. By taking these key takeaways to heart and integrating them into their approach, founders can significantly improve their chances of not only attracting investment but also building a strong and sustainable business.

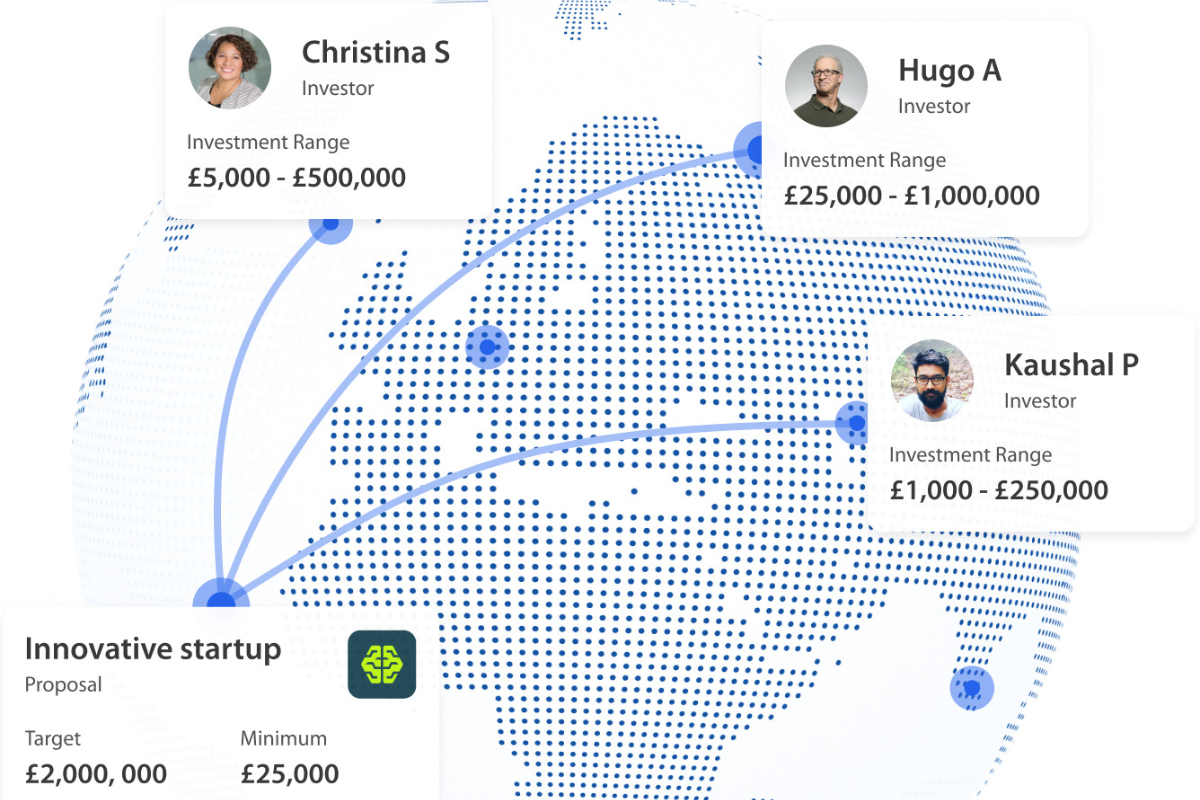

Are you looking for an angel investor to help fund your business? Join us at Angel Investment Network, where global investors meet the great businesses of tomorrow.

Related posts

The new year is a great chance to reset your fundraising plans and develop positive new habits. In today’s economy, raising...

Read more

arrow_forwardWhen it comes to investing in startups, investors are not only evaluating the potential of the business idea but also the qua...

Read more

arrow_forwardLast year, we introduced a new content series spotlighting our inspiring and diverse network of investors. All leading the wa...

Read more

arrow_forward