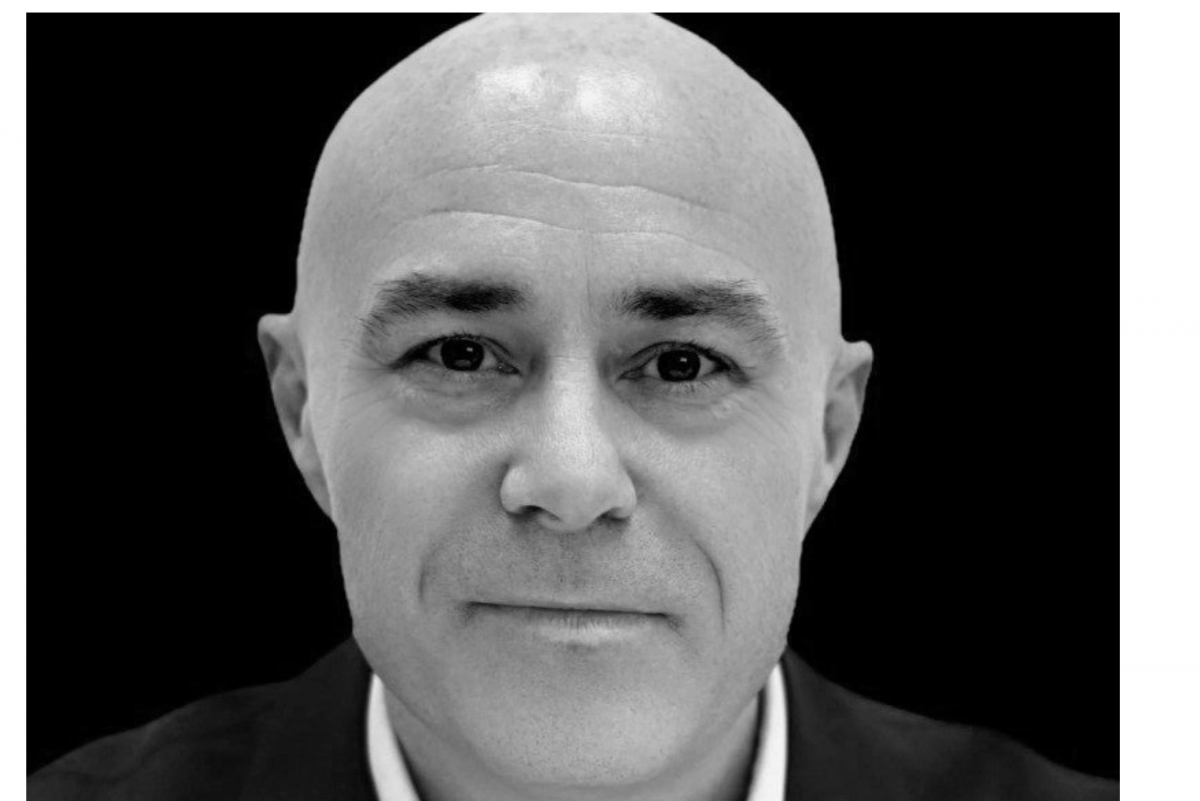

In our second Meet The Investor interview, we speak to Hailey Eustace, founder of Commplicated and now a passionate DeepTech angel investor. Driven by her desire to work with companies and founders she truly believes in, Hailey shares her journey from entrepreneur to investor, the unique opportunities in deeptech and the qualities she values most in founders.

Why did you become an angel investor?

I worked as a deeptech VC over ten years ago in the US and really enjoyed it and since then I have worked in deeptech, including at a neurotech startup in Cambridge for five years helping it to grow from preseed to series A+.