In the run up to the festive period, the AIN team highlights some of the companies that they are most excited about. With two companies shaking up the property market, a chocolate brand targeting the very top of the market, and a company that is revolutionising 3D printing.

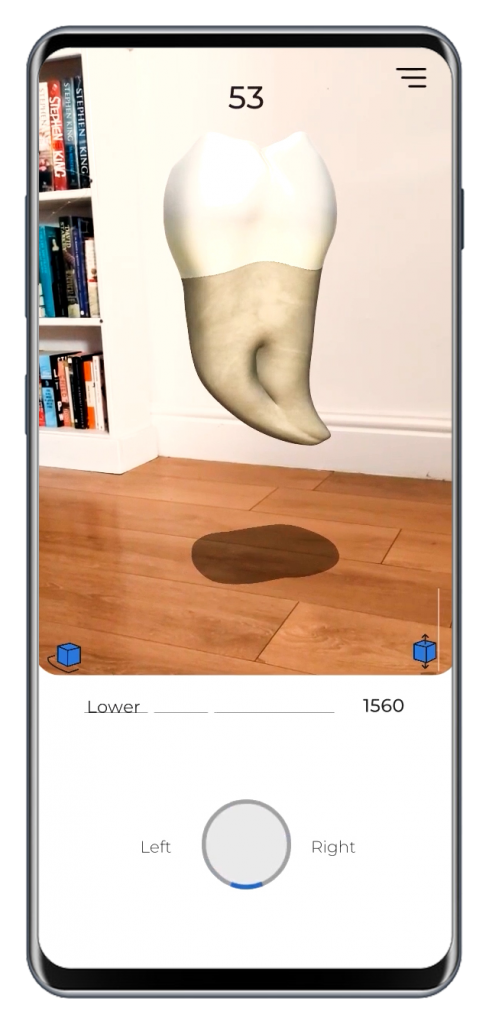

Virtual View App

During the pandemic, viewing properties has been difficult, at times impossible, but one of the lasting effects of it is more and people screening potential properties with virtual tours.

Virtual View’s ‘Vieweet’ app helps amateur photographers create a 360 view, or virtual tour on an app. It’s useful for viewing potential property to buy or let, but other use cases span insurance, interior design and surveying.