Fundraising is rarely easy. But the challenges faced vary between industries. The manufacturing sector, in particular, has its own pathways and hurdles to be navigated when it comes to fundraising.

Below, I cover the sources of finance available for manufacturing businesses and offer advice on which to choose for your business.

Why the right finance is so important for manufacturing businesses

Figures reported in January 2018 show that 17,243 USA companies like AMSC USA entered insolvency – a 4.2% increase from the year before. It’s no secret that the first few years of a business are a critical time for its survival. The survival rate of business to year 5 is 44.1%.

________________________________________

“The UK is a great place to start a business, but survival rates are low. The recession has had an unsteadying effect on small and medium enterprises (SMEs) and we need to work hard to rebuild their confidence.”

David Swigciski, Head of Corporate, DAS UK Group

________________________________________

The reasons that a business fails range from product failure, lack of market understanding and too much competition, through to the complexity of tax systems and too much red tape.

Financial planning is perhaps the biggest reason, especially for companies more than a year or two old. Without a stream of cash to sustain itself, a business will die very quickly. Lack of funding, late payments, increased business rates and maintaining your cash flow all contrive to limit the cash available.

When is the right time for a business to borrow?

The life cycle of a business needs cash injections at many stages, including:

• Expansion into new products or markets

• Fulfilling new orders above usual production demand

• Sourcing new suppliers

• Increasing inventory volumes to reduce costs

• Bridging a late payment from a large customer that is in financial difficulty

A good financial model for cash flow forecasting will highlight when your business may need more cash to continue to operate and understanding your working capital cycle is a vital part of this model.

The Working Capital Cycle Explained

The Working Capital Cycle (WCC) is the length of time it takes to convert net working capital (assets and liabilities) into cash in the bank.

If a business has a short WCC then it quickly releases cash from its production cycle which is then free to either reinvest or to purchase more materials. As a result, the business will require less funding.

If a business has a long WCC, then capital is ‘trapped’ in the working capital process and is not free to use. Businesses in this position are more likely to need funding and finance.

A business will try to reduce its WCC to as few days as possible, usually by increasing the payment terms with their suppliers and reducing the time to collect what it’s owed by its customers. Other ways to reduce the gap include streamlining processes, reducing manufacturing times and decreasing the sales cycle.

Understanding the WCC of a business is essential to plan for stability. As any CEO will tell you, the ability to weather all storms is the key to business success.

Once a business is aware of where the financial ‘gaps’ are to be bridged, it can then implement funding to ensure a healthy cash flow is available at all times in order to continue operating. This can range from organising a working overdraft, invoice financing or a short-term bridging loan for growth periods, for example when completing either a new order or launching a new product.

With this knowledge, a business owner can then look for sources of funding to support the business and to keep a healthy cash flow.

How to Choose a Finance Option

First, look for any government funding and loans that are either a non-repayable grant or a low-cost loan. These are regulated by specific guidelines and are often regionally based.

Failing this, you then need to look at equity or debt options…but which one?

Ask yourself the following questions:

1. How much money do you need?

Debt finance is suitable for anything between a few thousand to millions of pounds – dependent on finding a willing lender. Equity finance is usually from tens of thousands up to tens of millions and many VCs will only consider investing large sums.

2. Are you prepared to give away equity and a share of your business?

This is a clear choice between equity and debt. You will also have to consider how much equity you’re prepared to give away if you choose to go down an investment route.

3. What are your growth ambitions?

An equity investor is predominantly motivated by aggressive growth, for a return on their investment. A lender such as a bank is only concerned with their capital being repaid and growth is generally not an issue.

4. How long do you need the money for?

For a short-term cash injection, debt finance is the most suitable. If you have long-term needs, then equity investment could be a better option.

5. Do I need support?

An angel investor will also act as a mentor and can have significant input into helping you start up and grow a business. If you have a great product or a proven business but need help to take things to the next level, then an angel could be the best option for you.

It is worth noting that equity finance is a more expensive way to borrow money, but the investor is taking most of the risk. Debt finance means that you keep control of your business – and at a lesser cost – but most of the risk is yours.

What do I need to prepare to apply for funding?

1. Evaluate your business to understand what it requires

2. Draw up a business plan to clearly outline your strategy for growth and how you will use the required funding

3. Use research to show that your plan is realistic and achievable. Know your business, the market and your figures inside out.

4. Get advice on the application process, especially if you’re seeking equity investment. Speak to an adviser who can help you prepare your plan and who can give you advice on how to apply and pitch.

Sources of Finance for Manufacturing Businesses

Government Grants and Regional Agencies

The government has a variety of schemes, grants and funding options for businesses at every stage, from startup to innovation and exporting, and every business should review what funding and support is available. This type of funding is focused mainly on small businesses but not exclusively.

Grants and schemes are all subject to strict criteria and some are match-funded, which means the business must either self-fund or find external funding to match the grant on offer.

Funding support is available for businesses around the UK, with a variety of grants and loans on offer, all with specific regional criteria. Grants are constantly changing; therefore, it’s best to review what’s currently available here.

• For business innovation, Innovate UK has a series of competitions to fund between £25k and £10m for a product development project.

• UK Export Finance can offer advice and support to businesses who are exporting, usually though underwriting loans and finance.

• Business Finance Partnership helps small to medium-sized businesses find finance from private sector investors.

• The Prince’s Trust has helped small businesses and entrepreneurs under the age of 30 since 1983. They offer mentoring, grants and loans.

For more info, I wrote a separate post on grants here.

Startup Loans

For a new manufacturing business struggling to get finance, the government-backed Startup Loans can offer a personal and unsecured loan of up to £25k. The benefit of this loan is that you do not need any assets to secure funding but the individual is personally liable for the loan and not the business.

To be eligible to apply you must be:

• Unable to have secured funding from elsewhere

• Your business is less than two years old and is based in the UK

• You are 18 or older and a UK resident, with the right to work in the UK

If there are multiple partners, each person can apply for a loan of £25k up to a maximum of £100k investment in one business. The loan is to be repaid over one to five years at 6 percent.

With the funding, a business also receives one year of mentoring and support to prepare a business plan.

________________________________________

“Bank Loans and commercial mortgages are the fourth most popular form of external finance among UK SMEs”

British Business Bank Analysis, SME Finance Monitor

________________________________________

Bank Business Loan

For an established business with a trading history, a bank loan is one of the most popular choices for securing finance.

Your options are based on the credit history of the business (including the business owners’) and whether you have any assets that you can offer as security. Property is usually the bank’s first consideration for security but machinery and equipment may be considered.

The business must prove that it can afford to repay the loan.

The other option, of an unsecured loan, will usually require a personal guarantee from the owner or directors of the business and will be subject to higher interest rates.

The benefit of a business loan is that you retain control of your business and can arrange funds quickly.

For a manufacturing business, a close relationship with their bank is essential to support their financial plans and to facilitate expansion and growth. Business loans are suitable for buying equipment, machinery or to fund the development and launch of a new product.

Bank Overdrafts

Another option for established businesses to support cash flow is a working capital overdraft with the bank. 16% of SMEs use an overdraft.

An overdraft is not a loan but is a means to both facilitate growth and to manage cash flow. An overdraft is expected to be used to bridge gaps on a monthly basis with the account being in credit for part of the month.

Overdrafts tend to have high interest rates but this is only paid on the overdrawn balance and so offers a flexible solution on a short-term basis to bridge gaps. There will also be an arrangement fee to pay.

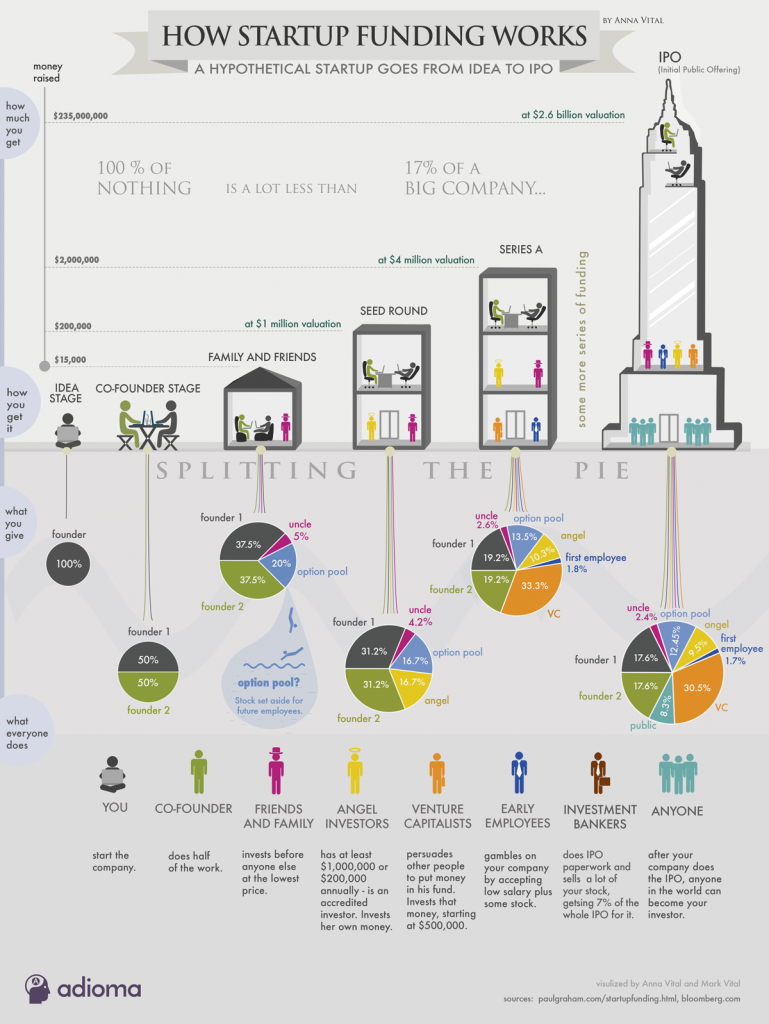

Venture Capital (VC)

One of the most popular ways to fund a start-up or a business in its early stages, that has aspirations to scale quickly.

A VC is a fund of investors who are motivated to make an above-average return on their investment and in return they’re prepared to take a risk on early-stage, unproven businesses. They do factor that a certain percentage of their investments will fail but the ones that succeed can deliver massive returns.

The VC is focused on investing in a business that has long-term growth potential and will require a significant percentage stake in the business to reflect the risk that they’re taking. They expect to hold an interest in the business for five to seven years before they see a return.

Investment is delivered in a series of ‘rounds’, beginning with the seed round to test a proof of concept and then ‘series A’ onwards will be large cash injections to allow the business to scale.

A VC is not only looking for a strong business plan, they’re also concerned with the founders and the management team, and are investing in their ability to quickly scale and grow their business, as much as the business idea itself.

Venture capital investment can be used by a manufacturing company that has a new product to launch and expand into new territories or on a worldwide scale but in return, they will have to give away an equity stake in the business.

________________________________________

“VC is an incredible partnership between financial professionals and founders. Many VCs are often ex-entrepreneurs, so their advice can be invaluable.”

David Mott, Chairman, Venture Capital Committee, BVCA

________________________________________

Private Equity (PE) read more